MtGox, the oldest and once-largest bitcoin exchange, appears to have a serious problem. Since about a week ago, clients’ bitcoin withdrawals have been deducted from their account, but the clients never received the money – the money withdrawn was effectively disappeared into thin air. The community is furious and as of now, MtGox has racked up over USD 38 million in such unfulfilled withdrawals.

MtGox was once the undisputed king of the hill among bitcoin exchanges. If MtGox froze its trading, which has happened, then bitcoin trading froze as a whole – the exchange was that dominant. In the past year, other exchanges have gradually sprung up, and today, MtGox accounts for about one-third of trade – it’s still a very strong player, even if not dominant.

MtGox has always had various regulatory problems transferring funds in and out of US Dollars, but according to client testimonies and reviews, other central-bank currencies – euros, yen – have always worked like clockwork. Since about a week back, though, withdrawals of bitcoin – the opposite of central-bank currency – from the exchange have started to fail in a seemingly random fashion.

When bitcoin funds are transferred, that normally happens instantly – the received sees the funds within seconds. That’s one of the strengths of bitcoin: you can transfer money, unlimited amounts of money, anywhere in the world instantly and unstoppably.

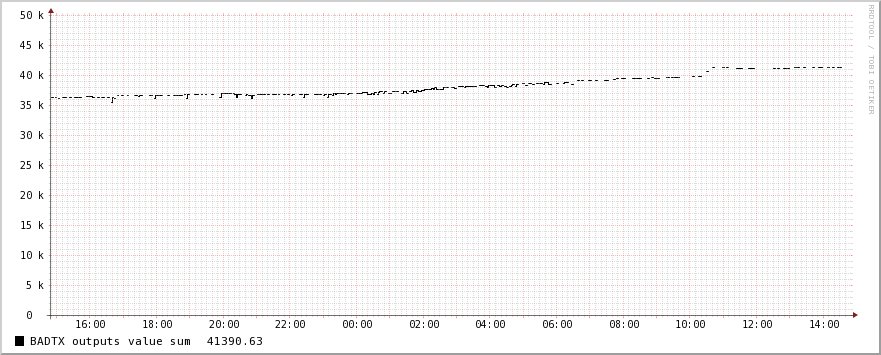

Since about a week ago, MtGox has not processed all requested bitcoin withdrawals and many clients have not received their bitcoins. Instead, some of the withdrawals were processed while the rest of the withdrawals remain frozen in an undetermined condition. Affected users are upset by this since the money is gone from their account, but the bitcoins have not been transferred to the client’s control. As of noon on February 4, The Gox Report has this chart, which is based on MtGox’ own internal data:

Note the bottom, the sum of all “failed transactions” (BADTX), which is technospeak for “withdrawals where the money is gone from the client’s account but where the funds were not actually transferred to the client”. The total of such withdrawals, a total that has been steadily climbing since about January 25, has now reached 41,390. That amount is in bitcoin, and each bitcoin is worth $934 by MtGox’s own rate, making the disappeared client money exceed 38 million US dollars. That’s not exactly small change.

Three years ago, I highlighted exchanges as one of four areas where the bitcoin community positively must improve to go mainstream. The above problem of the missing 38 million dollars is exacerbated by the fact that MtGox does not respond to clients’ questions until well over a week has passed, at which point a canned autoresponse is given. Additionally, there has not been any communication whatsoever about the ongoing problem. The lack of a phone number, the non-responses to client concerns over tens of millions of missing dollars, and the complete absence of messages about the situation does not make a professional operation.

Instead, clients of tens of millions of dollars are left on their own trying to figure out what is going on, if they’ll get their funds or not, and if so, when, and what the underlying problem could possibly be.

(I was recently asked by the Wall Street Journal in what ways MtGox failed to live up to Wall-Street-level professionalism, and declined to respond at the time. This is one of those ways. There are others, that are worse, that I have not published yet. That WSJ article concerned delays in withdrawals to dollars and euros, which could be explained by legacy-banking inertia; up until ten days ago, MtGox had executed bitcoin withdrawals perfectly.)

Looking at the bitcoin services forum, there are tons of complaints with the current exchange services. The entrepreneur should identify several opportunities here, just by looking at the front page of “discussions”, which read more like outraged complaints – mostly about MtGox.

As of February 4, clients are left speculating in these threads what the reason for this behavior is – whether it’s legitimate technical problems coupled with abysmal communication, deliberate fraud, possible insolvency, a technical attack on MtGox, or a number of other theories.

The author is personally affected by MtGox’ behavior, having a six-figure dollar amount in such non-executed withdrawals. He considered Gox to be a safer repository for bitcoin than his own probably-hackable computer. That judgment may not have been accurate.

UPDATE 1: One hour after this article was published, MtGox broke the week-long silence with a statement saying little more than “we’re working on it”. In the statement, they also claim that the problem applies “primarily to large transactions”, a statement that doesn’t seem entirely correct when compared to client statements and testimonies on the bitcoin forums.

UPDATE 2: Three days after this article was published, on Friday Feb 7, MtGox disabled bitcoin withdrawals entirely in order to, according to them, sort out their problems. They’ve promised to return with a statement Monday as to how that went.

Looks like an outright theft to me.

Why aren’t clients calling the police?

You must be new to bitcoin. Shit like this breaks all the time. Doesn’t always mean it’s theft.

You must be new to bitcoin. People who use bitcoin do so because they want to stay as far away from the police as possible.

They have just made an annoucement > https://support.mtgox.com/entries/26128504-Update-Statement-Regarding-BTC-Withdrawal-Delays

Let’s hope everything will be fine

[…] 01:13 PM Major Bitcoin Exchange Not Executing Withdrawals; Now Owes Clients $38M In Disappeared Money – Falkv… Peace, kowalski Be […]

Zirgs, could you explain to me what it is – exactly – that has been stolen?

“Officer, officer, he stole my bits”.

“Calm down enraged citizen. Here is a handful of bits, new and shiny. Now goaway please.”

At least Falkvinge says that bitcoins are real money – no worse than USD or EUR.

And when someone steals your real money – you call the police.

So why not do that in this case?

Being real money is not the same as being regulated by law. The police cares about the law, not about money.

Are you saying that stealing bitcoins is not a crime?

Assets are assets, it dosen’t matter if it’s 10000 USD worth of virtual pokémon cards the police will still consider it theft in most nations. There actually been a few non-bitcoins legal situations involving this already.

“Being real money is not the same as being regulated by law. The police cares about the law, not about money”

My ass. You don’t know the system, do you.

The police have always cared about money. Especially money that hits their pocket. I don’ t know one judge, one police force, or one government agency that isn’t paid off, for one reason or the other, or in oner fashion or the other. Corruption is, and always has been a way of life for cops, judges, and political appointees. Do you think the recent HSBC scam perpretraters got away with it because they were poor?

This is about Dollars which have disappeared, not Bitcoins.

Oooops, seems I misread the article. It’s about the equivalent of $38M in bitcoins.

first thought .. hacked by #nsa/government, in order to discredit bitcoin concept

first thought: shut the fuck up, conspiritard.

You would have said the same thing a year ago to someone claiming the NSA was spying on most of the internet, wouldn’t you?

This is a comment field, intended for comments. It is not very nice to tell people to not comment for any reason, much less just because you say with certainty that what they say is false, even though no one outside of US govt. can possibly know that.

Because of course anyone believing the NSA would actively hack infrastructure providers outright and threaten them into compliance with enforced NDA regulation?

Oh, wait, all that actually happened.

“Conspiritard” or “tinfoil hat” aren’t words to use after Assange, Manning and Snowden.

MtGOX is a Gold sponsor of the Bitcoin Foundation.

Mark Karpeles is a board member of the Bitcoin Foundation.

The Bitcoin Foundation is aware of this SCAM since months ago.

Only big transactions are affected *winkwink* dont worry. Should work by now. Bigger bitcoin amounts use more bandwidth to transfer *winkwink* Everything will be fine

Looks like that people are closing the shop and are preparing to vanish with all the money.

That’s horrible. I hope you get your coins back, Rick. Mt Gox always seemed reasonably trustworthy, but I’ve always preferred to keep my few coins encrypted on a thumb drive.

Madoff seemed reasonably trustworthy too.

At least for a while.

Sounds like the beginnings of a collapsing ponzi to me….

Stop calling it ponzi, because bitcoin is not ponzi.

Call it fraud, theft, stupidity, technopositivity, naievty or FFS religion….

but not ponzi.

One can call it a ponzi-scheme. Just as in the case of Madoff. The early investors got their pie to lure in the whales who now is sitting on bitcoins which they probably one day won’t be able to access or convert to real money.

The thing with new things and new technology is that early adopters usually have an advantage over late adopters. Not much you can do about that, and frankly I don’t think anything should be done about it. If there was no incentive in trying new things, why would people bother trying new things at all?

It is a textbook Ponzi scheme, and it will collapse accordingly.

Humph, me too. Been a week now. Was always a bit wary but hoped for the best and now here I am, bereft of bits and feeling like a chimp. The worst thing about it is the deafening silence from MTGOX. NO news is almost certainly bad news…

Now Falk will claim, with the sting of his personal loss as a spur, that Bitcoin is too sensitive a subject to leave unregulated, and that he, and his “democracy” has the answer through legislation. Sorry Falk no one with half a brain cell will accept your ideas of how the world should work. You should have printed your Bitcoin out with Armory or bought a Mac, transferred the Bitcoin to it and kept it in a safe. The world does not need you to keep people safe from MTGOX, and your reckless carelessness with your own money disqualifies you from forcing a Bitcoin solution on others, quite apart from the basic immorality of the job you do.

Or…. This is just another shining example as to why Bitcoin will not be as grand as those betting on it think it will be.. The technology is good and sound and will be adopted by banks and large corporations. But to assume that BTC will be the next currency of the future is reckless and ignorant.

Early adopters are cashing out with the money that speculators and average Joe’s brought in. The current price is highly manipulated to ensure that the whales can cash out slowly and methodically without crashing the market. Basically protecting their investment in a somewhat criminal manner.

That you even use the term “cashing out” assumes there’s any more legitimacy in the types of money that banks or credit card institutions are more able to control.

Scandals like the one in Sweden where a company was denied being able to charge for stuff in an online shop ( selling sextoys and horror movies ) will keep cryptocurrencies interesting to anyone interested in the freedom of business.

Although many will dislike it, as there is always money to be made in unregulated markets, if Bitcoin ever wants mainstream acceptance, it will eventually be regulated to some extent. And governments requiring e.g. insurance on accounts seems like an entirely reasonable regulation which prevent many situations like these. The FDIC bolstered consumer confidence in banks for decades, and reasonable, common sense regulations from Glass-Steagall ushered in the longest peace time economic expansion in history.

It didn’t start a week ago, at least for small withsrawals. I initiated a ~$200 wire transfer in mid-October, promised 4 weeks, still waiting. Abandoned MtGox for good since.

Oops, still sleepy, did not realize it was about BTC withdrawals, not $ transfers. THAT is really bad. Glad I left MtGox. I do keep my bitcoins at home.

MtGox guys are propbably spending Falkvinge’s “hard earned” cash on hookers and blow as we speak.

And that “update” on MtGox site was posted probably just to troll people.

Yeah. When nothing else works, try spreading rumors of trying to shame and ridicule your opponents. Pathetic.

how’s about checking how much the FBI siphoned out? that could easily give a good answer. after all, the USA is quite happy screwing as many people as possible, all in the name of ‘the Law’!!

Maybe the problem is that people bought cheaper Bitcoins on other exchanges, then transferred them to Mt. Gox and tried to get euro’s or dollars back again from Mt. Gox in order to make a profit?

Finally someone who makes sense.

However, Mt Gox has always been slow in processing withdrawals, at least as long as I trade(d) there (for about one year). But I never lost anything and sooner or later all my funds – fiat or XBC – arrived.

Wollte Dir einfach mal in diesem Gaestebuch einen Gruss hinterlassen. :

)

Hey Danke fuer die schoene Zeit hier. Macht weiter so.

Da komme ich gerne wieder vorbei.

Hi Rick. thegoxreport has not been updating correctly for a few days so you might want to edit this post. You can find the guy behind the site in #mtgox on freenode if you need confirmation.

Hi Dave, thanks for the information. However, seeing as the number has kept growing until Gox issued the statement today, if it is a few days old, that would suggest the situation is just even more serious now.

Even if the number is a few days old as you claim, Gox owed clients $38M in unprocessed withdrawals at that time, so nothing material changes in severity of the situation.

Cheers,

Rick

These withdraw delays are going on for a while. Are you living under a rock Rick? Why do you else think the Bitstamp price is much lower then the Mtgox price for several months now?

You’re thinking of the well-known delays in USD withdrawals, which is the reason the exchange rate is much higher on Gox.

This article concerns BTC withdrawals.

Cheers,

Rick

There is a new site, coinsight.org, that is currently working. It has stuck transactions at just under 33000 BTC but that also includes change. On the other hand it doesn’t include week old transactions that were recently refunded to MtGox avvounts, like my own, so there is more BTC “wanting” to get out of MtGox. It gives a rough figure of how big an issue it is though.

Baha,”only large withdrawls affected..” my <2 BFC transfer is not showing up in blockchain for Rover 20 h now.basterds. trust is gone. will Jever gerade ob gox again.

Wow clear so much! Very grammar!

[…] MtGox, the oldest and once-largest bitcoin exchange, appears to have a serious problem. […]

No offence, but I would imagine that someone who invests such amounts of money into Bitcoin would do some more research about what is considered trustworthy. MtGox wasn’t considered a secure place for that for at least the last few months already. I’ve heard stories about withdrawals being stuck for *months* months ago, so this isn’t anything new.

If you want a secure storage (you’re right that just keeping bitcoins on your computer isn’t good enough), look into how to set up a cold storage wallet (e.g. with Armory or Electrum). You can keep a wallet on a pendrive or external disk, backups on paper, and you can use it to send transactions securely without the wallet ever touching Internet even for a moment.

Traditionally, Gox has set the exchange value on Bitcoin for the whole planet … essentially defining the very value of the currency itself. If Gox said it was worth $850, then By-God, That’s what it was worth … Period.

Along come the robber barons, Bitstamp, Bitfinex and BTCe who, together with the likes of coinbase, conspire to manipulate the market, destroy MTGox and make a real ton of money in the process.

THEY decided together to set the value of Bitcoin from $100 to $200 less than Gox. YOU see the difference as the lower price that THEY are willing to pay when you try to buy or sell coins through their exchanges.

You end up paying A LOT MORE when you buy and getting A LOT LESS when you sell your coins and convert to fiat.

Coinbase, for instance, might typically give you only $834 for a Bitcoin that Gox says is worth $1000 … tack an extra 10% fee on top of the transaction and then exchange their “stolen” Bitcoins for an even bigger profit by moving them through a Gox trade.

Gox Hemorrhages money, fails in nearly every respect to respond to the threat and comes to an end that we have all witnessed.

The robber barons continue to steal 20 percent of every transaction we make.

I’m not sure where you’re getting your info,

but great topic. I needs to spend some time learning much more

or understanding more. Thanks for wonderful info I was looking for this info for my mission.

Do you know where mtgox is located?

Have you met anyone from their staff?

Can you call them?

Did you sign a contract with them?

Do you know if they have a deposit insurance?

If the answer to any of the above is no then you should not trust them with 6 figure sums of money – especially when they are not paying any interest.

[…] by blackswanmx [link] [3 […]

They posted a Updated Statement on the problem

https://support.mtgox.com/entries/26128504-Update-Statement-Regarding-BTC-Withdrawal-Delays

“YOU CAN’T TAKE MY MONEY! I HAVE A BLOG!”

Love you, Rick. <3

Seriously, though, this is pretty awful. I think it's a good wakeup call, though. You'd expect an institution operating with Bitcoin to be just as financially sound as the currency, but probably not. I doubt Gox has anything more than a fractional reserve of fiat, and for all we know BTC. They're basically a bank and I don't think they'd survive a bank run.

I like Blockchain's approach where the keys stay entirely with you, and they're just a cloud hosting an encrypted version of your wallet.dat (assuming they're telling the truth). I wonder if there's a way to run an exchange site on those principles.

I started looking at arbitrage-rally-news when I realized the price difference between mtgox and bitstamp seemed to be increasing extremely rapidly…almost felt like two completely separate markets. Serendipity or perhaps, but within 24 hours I started seeing people pissed off and conspiracy theories everywhere. Thought: if the current bitcoin community, which is pretty steadfast, can withstand SilkRoad, China, etc. I think the basic tenets of the market will survive if mtgox ends up going belly up or other nefarious plot-twists. It’s only if the structure/encryption/method bitcoin introduces gets a gaping hole that the currency/commodity/whatevs will collapse fully. If MtGox is indeed going down, I will spend my measly hoard on cute electronic doo-dads, then try to find the bottom of the pit and buy back in. I’m looking at $500 or less on bitstamp then jumping right back into the game because through all the trolling and fundamental economical doomsday predictions this sucker has teeth and will not go away. Rick, best of wishes on your six figures, but don’t give up on the method if a branch falls off!

Agree completely. It seems as if Bitcoin is here to stay. The cryptographic scheme linked with the financial structure seems stable so far, and for an invention like this to hold so far means it might have a valid hold in our worldly economy.

[…] -MtGox 비트코인 출금에 큰 문제 생겨 […]

It is not true that only large deposits are affected. I am waiting for withdrawal of $964! It has been more than 2 weeks now, and no funds in account! No response either.

[…] Fuente: falkvinge.net […]

Gox is dead baby, Gox is dead

– http://www.youtube.com/watch?v=y7Yp2L6c2KM

Lol, too damn funny

[…] is happening to the withdrawn BTC. According to Rick Falkvinge, Pirate Party’s founder, who wrote about the matter in his blog, Mt. Gox has so far amassed more than $38 million in over 41,000 unfulfilled […]

[…] is happening to the withdrawn BTC. According to Rick Falkvinge, Pirate Party’s founder, who wrote about the matter in his blog, Mt. Gox has so far amassed more than $38 million in over 41,000 unfulfilled […]

Mt Gox is a shady operation. I made a withdrawal request 40 days ago. After going through multiple steps to “validate” my account, and then to increase my withdrawal limit, they still have not sent funds. One response from my many service tickets said they could accelerate my request with a 5% fee.

What?!? Seems they have the capacity to get it to me faster and choose not to.

Now, my account doesn’t show the cash amount I requested for withdrawal. 3 tickets submited requesting an explanation where the money is. Nada.

I’m pissed. Stay away from Mt. Gox.

Sorry but I feel something fishy going on not just on Mt. Gox. Why on earth would Rick have his bit coins on Mt Gox? Why Why Why? And why has he just now (after being asked countless times before) declared that he has a six figure amount in dollar of Bitcoins? Why Why Why?

Mt Gox has had a lousy reputation for years.

“His own probably HACKABLE COMPUTER”

Now that was funny! Wonder how Rick could sleep at night.

When I started with bitcoin, there was only MtGox. Keeping coins there for my pathetic attempts at daytrading was easier than starting and re-tuning for a new exchange, as long as it seemed I could withdraw my euros and btc without much effort.

I didn’t declare I had a 6-figure dollar amount in bitcoin. It’s rude to reveal the size of your position. I declared and disclosed that I had a 6-figure dollar amount in frozen withdrawals from MtGox, which is a) relevant to the article and b) a different thing – it’s something that used to be a subset of my position, and may or may not be part of my position again.

But I find it strange that you who have been a loudmouthed promotor of Bitcoin and its ease of use for a long time now, finds it hard to move your coins around to safer havens than Mt Gox the site which is known for having countless troubles and which have been hacked several times.

OK so you maybe have more Bitcoins at Mt Gox. Good Luck! Have you by the way declared your past Bitcoinprofits to the Tax-people?

There are a few errors here. The 38 million dollars include change sent back to MtGox. In my experience the change txout is often larger than the txout going to the customer because MtGox use transactions to consolidate dust in their own wallet. The number include some deposits as well. A deposit to an address belonging to an imported private key must be transferred to an address which only MtGox know the private key for.

Ironically the problem was caused by MtGox’s transparency in the first place, and made easy to exploit by a change in the standard bitcoin client (bitcoin-qt). MtGox use their own homemade client, of course, and were left behind by the change. I am not going to disclose all the details here, but leave it up to MtGox when they are ready. I assume they will wait until they are 100% sure the cause of problem has been fixed, and is unexploitable everywhere. The most visible consequence is, in short, that their wallet and the blockchain disagree on the utxo set. This has led to casqading problems, and is not easy to fix.

But there’s a mystery here. If you look at https://data.mtgox.com/api/0/bitcoin_tx.php and look up your transaction there you’ll notice that the reason why your transaction doesn’t get through is because the outputs have already been spent. Take my current (stuck) transaction which is:

b2ab0930acbc18e9ba4d5415025ed6022ad8b0c657b4ec51edbf5caa628c5295

which consumes only one single input which is:

“in”: [

{

“prev_out”: {

“hash”: “2a9085d5476aa3965e498af7245d9271d632ce01f159a6d5f445b91404927070”,

“n”: 0

},

“scriptSig”: “(redacted)”,

“addr”: null

}

],

i.e. it wants to spend the funds of output 0 of 2a9085d5476aa3965e498af7245d9271d632ce01f159a6d5f445b91404927070

However, if you look for the above transaction hash in the list you’ll notice that there are 5 transactions that want to spend the same output which is definitely illegal according to the bitcoin protocol!

None of these 5 transactions got through, and the 6th transaction that actually got it is not in the tx_list (MtGox flushes the txes that go through). Therefore, at the time of BTC withdrawal, there were 6 double spend attempts and only 1 got through. I had a 1/6th chance of getting my transaction through and now I need to roll the dice again (I guess I have to wait for 48 hrs or so)

This points clearly to a race condition / concurrency problem at MtGox on BTC withdrawals. Or how do you explain this otherwise?

Thanks,

Datavetaren

The number of transactions trying to use the same input is surprising, but more than one is common for stuck transactions. MtGox will try to cancel transactions which have been stuck for a while by spending one of the inputs in another transaction, and thereby make the first transaction invalid so it can be tried again. I’ve seen them do this several times over, but 5 transactions at once is a new record.

I am somewhat puzzled by the fact that they still allow users to withdraw and attempt to do the transactions despite of the sad state of their wallet. I think it would be less frustrating for their users and easier for MtGox if they just put withdrawals on hold, waited a reasonable time to allow for confirmations, did the accounting, got their utxo set in sync and then start up again when everything is in order. But it is easy to give advice when I don’t have the complete picture..

I can understand why they aren’t more open about the source of their problems, since other exchanges, merchants and online wallets may be vulnerable to the same bug or a variation of it. Just very much harder to exploit.

I know, and I think most users have this problem, but wait, WHY is MtGox reusing the same output for multiple transactions?

This can never be valid and it is completely meaningless! An output can only be spent in full (according to the bitcoin protocol).

If you look at the original client, the SelectCoins() functions is guarded with a mutex (in CreateTransaction) so it should never be the case that two withdrawals should use the same output. There’s a flag in CWalletTx (vfSpent) which tells what outputs have been spent, so you don’t have to look for a successor transaction whose prev_out is pointing at the output in question.

Making sure that an output is only spent once is absolutely trivial to implement with some basic understanding in concurrent programming. Why does it take so long for MtGox to fix this?

Gregory Maxwell, bitcoin developer and known for free codec development under xiph.org, has explained everything here:

http://www.reddit.com/r/Bitcoin/comments/1x93tf/some_irc_chatter_about_what_is_going_on_at_mtgox/cf99yac

The same lesson that the Cypriots learnt last year: your bank balance is not your money. It is a loan you have made to the bank that the bank may or may not make good on. That’s the same whether the balance is in government currency, gold or bitcoins.

Actually a lot of cypriots got money “confiscated” which were not theirs i.e. loans sitting in an account. And most Cypriots did not more than 100.000 Euros which was the unsafe amount.

So the people who lost money were either seriously rich, some probably tax cheaters, or really unaware of that they had bony in banks with big problems.

criminalizing the victims of the cyprus heist let’s the sheeple sleep at night.

What victims? As I said a large amount of the money “confiscated” was not the accountholders It was loaned capital from the banks themselves.

Withdrawing/sending BTC from Mt. Gox hasn’t always worked perfectly. At the end of November I tried to send 9 BTC to a private wallet. The Mt. Gox website showed the withdrawal instantly, but my wallet (and checking on blockchain.info) didn’t receive it. Minutes passed, then hours. So I contacted support. Eventually 20+ hours later the transfer happened. Support got back to me after about a week. Useless!

[…] Fuente: falkvinge.net […]

“There are others, that are worse, that I have not published yet. ”

What are you waiting for, biding your time to enhance the impact?

If you know things, I think it incumbent upon you to make them known.

Is it just me or is Bitcoin merely one version of a technology, and this technology can have an infinite amount of versions?

For example, whats to stop someone from taking the BTC code and making BTC2 or BTC3?

Why cant banks and governments use the BTC code, or something based on it but tweaked abit, and make their own crypto?

Because if thats the case, wouldnt Bitcoin be worth nothing since it is infinitely clonable (and obviously WILL be cloned because no one owns the code)???

Seems like the technology that BTC has brought is promising, but that doesnt mean that Bitcoins themselves are how that technology will emerge to service the financial needs of the future…..

Dogecoin, litecoin-

Actually, I think everybody would be happy if the government produced a max amount of money at a predictable rate (rather than printing a variable, loaning it to a bank, and then borrowing 10x).

There was talk that the Bank of Canada was working on an electronic currency to work in parallel with physical currency. I’m guessing it’ll be a variant of BTC, and that only the government will have miner binaries for it. I imagine that they’ll release a wallet app…

The value in bitcoins isn’t scarcity (fork! fork! fork!), it’s the fact that we’ve collectively sat down and agreed to treat this crypto-cash as money. In fact, that’s the way it normally works in the “real world”: people pay in currency because the shopkeeper has agreed to treat it as valid payment.

To answer your questions:

“For example, whats to stop someone from taking the BTC code and making BTC2 or BTC3?”

There are already many spin-offs by forking the official Bitcoin source code into many other cryptocoins (Litecoin, Dogecoin, etc.) But the software is not the only thing that defines a cryptocurrency; it’s the network effect as well. Currently, the hashpower for Bitcoin is outperforming anything else on the planet; it’s power is bigger than any super computer ever invented (including the SETI project).

Compare with TCP/IP: Nothing stops you from inventing a better protocol than TCP/IP, but nobody will use it anyway because everybody is already using TCP/IP. In comparison, nothing stops from building new stuff on top of Bitcoin Blockchain, which is what is called meta-coins, which are new financial instruments and this is going to be really interesting.

>Why cant banks and governments use the BTC code, or something based on it >but tweaked abit, and make their own crypto?

This is a very interesting question, but to answer it you would have to understand how the current Bitcoin protocol works. The whole point with the Bitcoin protocol is the reward system and it’s peer-to-peer network effect. In essence, participants called miners will try to verify transactions (that are broadcasted by users). Each miner will try to bundle a set of transactions into a block and then try to solve a very hard mathematical puzzle to insert this block into the Blockchain. If a miner succeeds (solving the puzzle) then he/she is rewarded with X coins. Therefore, there’s an incentive to participate and make the network stronger. If a government would create a cryptocurrency they would like to have control over it which means that it won’t be decentralized and thus it won’t be able to gain that international trust that is required to uphold the network effect. Once you understand the pieces on how Bitcoin works, it is so ingenious that it just blows your mind away. I think this concept being applied to any central system (big banks, governments, etc.) would be very difficult. Just getting all these parties to agree is like getting politicians to agree on anything (what the rules should be to emit new coins, etc). Just look at the carbon reduction summits on the global warming issue and you’ll see how hard it can be.

>Because if thats the case, wouldnt Bitcoin be worth nothing since it is infinitely >clonable (and obviously WILL be cloned because no one owns the code)???

Again, the network effect is the other thing. There are so many computers upholding the Bitcoin network; you can’t clone that.

>Seems like the technology that BTC has brought is promising, but that doesnt >mean that Bitcoins themselves are how that technology will emerge to service >the financial needs of the future…..

Why not? I believe in Bitcoin taking over the planet. Just give a couple of more years. It has grown enormous over the 5 years, and keeping that exponential growth reminds me how WWW grew back in 1994. I’m absolutely convinced that Bitcoin is going to be next big thing. MtGox is just an exchange. There are more exchanges. Even if MtGox goes away Bitcoin is still with us.

It would seem that what is giving Bitcoin its value is the network. Isnt it safe to say that the netword power wasnt all too great prior to Bitcoin going into a semowhat bubbly phase?

People mine it and participate in the network to earn money; they have an incentive. If Bitcoin value drops, one could assume the network rate would drop too. We have seen this one a smaller scale with the apparition of the coins; people use their computing power to mine the new coin in town..

Mining = verifying transactions. There’s a mutual dependence between those who want to make transactions and those who verify them. As long as the cost of electric power to verify a block is less there’s an incentive to continue mining, even if the price goes down. Given that we get more power efficient ASICs with more hashpower it will balance itself quite nicely.

The bubblyness was insecurities in centralized transaction websites related to people wanting to trade dollars / euros / rubles for bitcoins or the other way around. When the site went down, the value plummeted because it was one of very few ways you could trade bitcoins for other currencies. Also some bubblyness because of insecurities regarding the legality of such trading sites in various countries.

The value will remain low and somewhat unstable for as long as the transactions are mainly speculation and transfers between currencies. But when people start actually buying and selling stuff and services using bitcoins that’s when the value could get real big and we will probably see politicians start talking of trying to regulate it.

Right now on coinmarketcap.com there are 88 coins listed!!! It would seem like anyone with a little time and coding skills can make their own coin and sell it into this hysteria. And every week the money flows into new coins, promoting them, pumping them, and then essentially dumping them.

This seems like a seriously rigged game, and I have a feeling that its being run by a small group of Devs who know each other very well.

This is clearly wrong on so many levels, I hope those running this have to pay their dues someday.

There, now I have finally translated my post about why I don’t think Bitcoin is the future of payment: http://integritetsnytt.wordpress.com/2014/02/05/bitcoin-isnt-the-future/

A little bit unrelated, but it’s about Bitcoin anyway.

What a piece of FUD.

1) It’s certainly true that the current state of the Blockchain is not that anonymous you would like it to be. However, it is by no means too difficult to fix this. The anonymity we have is at least way better than credit cards. There are projects like zerocoin which will fix the anonymity problems with Bitcoin (if we really want to go true anonymous).

2) Governments have not banned it. Actually, the future of Bitcoin in U.S. looks relatively good. More voices are proposing that Bitcoin should be granted and properly regulated (what the VAT and tax rates should be, licenses for exchanges, etc.) If U.S. will grant Bitcoin, the rest of the world will follow. (Like CDOs, derivatives and other financial instruments.)

3) No, banks will not go out of business. Banks make money on loans and loans will still be important in a 100% Bitcoin world. Central banks may go out of business, but that’s a good thing.

4) NSA hacking: Not a chance. The encryption algorithms out there are implemented and discovered by an independent research community (independent of NSA). I’ve personally gone through most of the encryption algorithms and as long as the encryption keys are long enough there’s no chance in hell NSA will be able to hack it. Furthermore, the design of Bitcoin is quite ingenious because the stuff on the blockchain never contains the encryption keys directly, but only the hashes of them. This makes it even resistent against quantum computing which normally is viewed as a threat against public/private key encryption systems.

So to people who are paranoid out there: It’s perfectly safe to use OPEN SOURCE encryption algorithms (provided the keys are long enough, > 128 bits for symmetric encryption > 1024 bits for asymmetric encryption). There’s not a chance NSA will be able to hack it.

I should complement myself on the NSA/encryption issue. Of course, nothing is perfectly safe if your computer is rooted. Given the latest revelations you should always assume that any closed operating system such as Windows, Mac OS X, et al. can be rooted by NSA. Therefore, the only way to ensure that you’re entirely protected is to also use an open source operating system such as Linux. Then you should be all set.

We even need “open source” hardware to be sure. NSA have been exposed to try and get hardware companies to do things for them too. We also need to be able to trust our ISPs in not being encouraged to censor bitcoin traffic.

1) The question is what governments, banks and mass media wants. Because in these questions that average people doesn’t take seriously enough to actively work with, that will be what happens. And when people begin understanding the problems it will be too late.

Very true, however that Bitcoin is WAY better than credit cards, PayPal and other services in this respect. But it doesn’t stand a chance towards cash.

2) Governments have banned it. Or at least declared it “not currency” in China. I think Russia had done something too, but I don’t know what. The US hasn’t banned it, yet. If it becomes regulated, be sure it becomes put under as much surveillance as credit cards.

3) Central banks was perhaps the primary thing I meant with “banks”. They are huge, they control lots of money. I.E. they control pretty much everything.

4, complement and Gurrfield’s answer) Crypto is hard stuff. The smallest error and it might be cracked. And if the hardware PRNG’s are compromised by the NSA, which we know that they have at least attempted to do, nothing is secure. Even if not, most people run Windows, so even if one feels secure having Linux, if all Windows Bitcoin stuff is compromised, the value will plummet.

I like Bitcoin because of it’s relative anonymity, speed, independence of banks, and so on. But I don’t think it is the future. It’s a shame, but I think it will inevitably die soon enough.

[…] MtGox, the oldest and once-largest bitcoin exchange, appears to have a serious problem. […]

[…] via Falkvigne.net […]

[…] The problems with Mt. Gox withdrawals are well-known, especially in the wake of the Swedish Pirate Party’s Rick Falkvinge publically expressing his Gox-related disgruntlement. […]

I tried making a transaction out of MtGox yesterday, at 09:00 CET. It has still not arrived in my blockchain wallet, 29 hours later. In fact, I can’t even see the transaction anywhere else than on the MtGox website: 2cec057c079e58043aa72e7bb3da04fa653b77fa3d91efbeba92e572730a469e .

“Cancelled transfer because of timeout”

So, basically no way to get my money out of Gox right now.

[…] överlag njugg. Flera av de företag som växlar ”riktiga pengar” mot virtuella slantar är i blåsväder. Som upplagt för svindel, skulle jag vilja […]

Bitcoin is the next big thing and will cost 100k soon – but i’ll sell it to you only for 800$ – seems legit…

Well duh, they won’t be worth anything at all if people don’t start wanting to use them in the first place. Any currency is worthless if you are the only person holding it and no one else wants it.

It may become the next big thing, the most important part being that shops start accepting them as payments.

Only fools would accept bitcoins at this price for real goods. Many people got their coins almost for free – therefore accepting bitcoins now is like giving your stuff away for free.

Current price is highly rigged and the only people that benefit from it now are those who bought btc 1,5 years ago.

It is far too early to say who are the fools. This is just the beginning.

[…] por Falkvinge que MtGox (la mayor casa de cambio en lo que respecta a monedas virtuales) tiene U$D 38 millones en operaciones incumplidas, esto es, los Bitcoins fueron retirados de las cuentas de los usuarios, pero nunca se les depositó […]

A couple of small Bitcoin transfers out from MtGox failed for me. The first one for 1 BTC on 30th Jan14 was returned to my account and the fee credited back yesterday. I immediately resubmitted the transfer out and this many hours later is has still not arrived at it’s destination. I presume, that like for the first attempt, it never reaches the blockchain. Any US withdrawals going back to 2 Nov 13 were not submitted to their bank for international withdrawals, and SEPA withdrawals look to have been delayed indefinitely, even though I got a couple through last last year. Looks like it’s too late to expect anything more out of MtGox. I’ll be amazed if this is not yet the end of it. (Please surprise me Mark K… 🙂

Happily, my losses with MtGox only make me break even with the Bitcoin adventure, and I understood the risk from the beginning, so never depended too much on it. But here’s the lesson of real life:

Even when you know someone is excited by the same ideals as you are, there is a sliding scale of the amount of trust you can extend to them depending on the amount of money involved. It’s very hard to keep that in mind when you are sharing the same excitement. Your own normal defenses fail to protect you from doing foolish things in that kind of context.

Moreover, remember money or assets that came easily are just as valuable, in fact let’s say it is twice as valuable as money or assets that you had to work hard for — that’s because they represent the freedom that mere hard work never entirely gets for you! So those freebies in life — be absolutely paranoid and protect them like crazy. Trust no one! Don’t consider them less valuable, consider them more so. Calculated risks re-investing them — well OK, but spread the risk, and don’t keep it in one place. And remember the meaning of “TRUST” — especially in contexts where it likely has no meaning!

Think about it. Most people you meet could hold $5 for you and return it later. Some people could hold $1000 for you and return it later. There are very few people who could casually hold $1 million for you and be trusted. Consider, if they could get away with that one theft, just once, it could make their whole life a different story. It’s an almost irresistible temptation. Tempt them with $100 million dollars — how many reading this could resist, if it looked like they could get it from strangers they don’t even know, and maybe entirely get away with it because of lack of regulation.

I don’t criticize Rick F. for being human. His ideals are admirable. Learning how far to trust strangers is not the same as wishing to stop the abuse of copyright controls, and wishing to stop abuse of central control by governments and the banking system.

But this is what we do when we entrust Bitcoin to an exchange — we entirely debase the ideas that Bitcoin was trying to improve.

Of course there is also this connection — governments would have never gotten as far as they have, if there wasn’t a dynamic that caused people to create them in the first place. It’s not so much that we can’t entirely trust governments, it’s more like spectrum of trustworthiness. You can hardly trust anyone at the level of total lawlessness, and then as you build social and “legal” structures around the problem you can create degrees of trustworthiness, increasingly so depending on how well society manages to construct them. However, there gets to be a point of no return, where increasing delegation to administrative structures starts to reduce trustworthiness again. Naturally we react against that, but the answer may not be to return entirely to lawlessness. So it’s not that delegating the problem of trust to social institutions is an entirely bad idea, it’s that it has never yet been good enough. It’s not something to merely react against, it’s just something that needs a total overhaul to make better.

Yes, resisting the excess and failure in government is important to make this happen. But no, we must not fall into the traps that these defective methods were intended to fix, if just because the fix was not good enough. There is the expression: “out of the frying pan… into the fire.”

Bitcoin, the algorithm, looks to make a cleaner process for us to work together with. But certainly the answer is not to emulate the old system by allowing too much trust to fall into the hands of one or a few companies, or institutions. This a serious technical mistake in understanding the issue that Bitcoin is intended to prevent.

We are so used to working with banks and governments we take a great idea, and throw it to the wolves immediately, by adding a layer of the same old stuff, as soon as we start to rely on “exchanges”.

Perhaps we can delegate quite a bit of trust to a non-human algorithm, but we should never delegate too much to other human individuals or small collections of them. Naked capitalism sounds like a great idea when we only focus on it’s benefits, but actually capitalism, to work at all, is entirely dependent on governmental structure and law. It is not some kind of natural wonder, in and of itself.

Yes, we could use the Bitcoin concept to shift and reduce over-regulation, but until governments make it easy to enforce implicit contracts internationally, it is exceedingly dangerous to trust any of your Bitcoin to operators not in your home town, and in that case you may as well, just learn how to maintain and protect your own wallet. For now, everyone excited by Bitcoin has to understand the process completely, and be in firm control, offline and virus protected. If you don’t have the time to get total control, time to understand how your smart phone is hacked all the time, and understand at least the structure of the algorithm behind Bitcoin, it’s like leaving all your money on your front lawn, or in the community laundry room, and hoping people will respect your right to it. In that case just don’t play the game yet.

The fact is that your chances of getting your money back from strangers, e.g, Mark Karpeles and MtGox, is very small, if you just hand some to them in a context that might not easily be covered by law.

Good luck Bitcoiners/everyone!

Austin Hook

Milk River, Alberta, Canada

I used mtgox to get into bitcoin way back in march 2013. As soon as the wiretransfers were completed i would buy the btc and withdraw the balance to my Qt-wallet and from there to cold storage. i left 20% on the computer to play around with in the different speculative venues, lost about half of that remainder and finally donated the other half, but… as a lark i tried to reconvert some btc to USD and wire it to my bank… after 8 weeks i told them to forget it and put it in btc in the account which i promptly transferred to my wallet. Never did business with them again. Whatever happens inside Mt.Gox is akin to trying to figure out if Schröedinger’s cat is alive, dead or napping. as of now. this final Gox disappearing act will benefit me since it’s giving me multiple entry opportunities to accumulate more through localbitcoins… The BTC ecosystem will still go through a lot of pain before a solid international merchant establishes a good standard of conduct. Gox flunked, badly. BTC still shining but it’s dormancy period will be extended till next BIG financial-monetary crisis (Cyprus was a gnat compared to the beasts lurking in the horizon).

Moral of the story: Be paranoid, it’s a survival trait.

cheap abercrombie clothes During the past year, starting

from the elections in November 2010 and ending

with the visit of United States Secretary of State Hillary Clinton in early December 2011, Myanmar has undertaken an exciting journey.

outlet abercrombie online Furthermore, the Obama administration claimed in October, 2009 that the stimulus plan had created or saved 650,000 jobs.

It also reported that $180 billion of the stimulus funding had been spent.

If you do the simple calculation, using only Obama’s numbers, you

see that each of the jobs created/saved cost about $277,

000 each to be created or saved. cheap abercrombie clothes

And remember dear citizens and illegals

that the liberals had full control of the Obama Whitehouse, and Congress for 2 years.

They were so concerned about taking taxpayer money and rewarding

their friends that they forgot about the economy. People seem to forget that when it comes

to the economy, liberals and commies have no

clue. abercrombie online(http://www.acheterabercrombiesoldes.com/)

[…] of the Swedish Pirate Party and IT entrepreneur Richard Falkvinge claimed on 4 February that Mt Gox has racked up $38 million in unfulfilled bitcoin withdrawals, where […]

[…] by Alibaba’s Taobao After China Tightens Rules – Bloomberg Mtgox scams $38 million from users :: Major Bitcoin Exchange Not Executing Withdrawals; Now Owes Clients $38M In Disappeared Money – Falkv… Mtgox OFFICIALLY stops all withdrawals :: […]

[…] of the Swedish Pirate Party and IT entrepreneur Richard Falkvinge claimed on 4 February that Mt Gox has racked up $38 million in unfulfilled bitcoin withdrawals, where […]

[…] For the last six months, the Japanese company has suffered from lengthy and unpredictable delays in the withdrawal of fiat currencies like dollars or yen. Many users have reported waiting four to six weeks to receive their money after requesting a withdrawal. Mt. Gox has had a history of trading difficulties and regularly has failed in communicating effectively with its users. Many hoped that earlier technical problems would be fixed by the shift in August to running Mt. Gox on Akamai, but that proved overly optimistic. Even prior to Mt. Gox’s letter, Richard Falkvinge, founder of Sweeden’s Pirate Party, claimed that Mt. Gox has accumulated more than $38 million worth of unfulfilled bitcoin withdrawals. […]

[…] The USD-equivalent of the bitcoins that had briefly ‘disappeared’ during the failed withdrawals from MtGox. […]

I just can’t get why people still had been using Gox, knowing that withdrawal problems started about 1 year ago? Me personally, I was having like 300 btc there in one moment, but as soon as I saw their money being frozen by USA, I switched to BTC-e.

Also, having secure bitcoin wallet is pretty much trivial. You just install Linux on a machine you tend to use not much for surfing, and you’re perfectly safe along with encrypted and backed up wallet.dat.

No way web wallets are safer than that!

[…] promised an update on Monday, but didn’t explain exactly what the issue was. Over the past week, complaints about Mt. Gox’s bitcoin payout problems have gown louder as the queue of unfulfilled withdrawals […]

[…] promised an update on Monday, but didn’t explain exactly what the issue was. Over the past week, complaints about Mt. Gox’s bitcoin payout problems have gown louder as the queue of unfulfilled withdrawals […]

[…] promised an update on Monday, but didn’t explain exactly what the issue was. Over the past week, complaints about Mt. Gox’s bitcoin payout problems have gown louder as the queue of unfulfilled withdrawals […]

[…] promised an update on Monday, but didn’t explain exactly what the issue was. Over the past week, complaints about Mt. Gox’s bitcoin payout problems have gown louder as the queue of unfulfilled withdrawals […]

[…] an refurbish on Monday, though didn’t explain accurately what a emanate was. Over a past week, complaints about Mt. Gox’s bitcoin payout problems have robe louder as a reserve of emptied withdrawals has […]

[…] entrepreneur and Swedish Pirate Party founder Richard Falkvinge recently accused Mt. Gox of accumulating $38 million in unfulfilled bitcoin […]

[…] entrepreneur and Swedish Pirate Party founder Richard Falkvinge recently accused Mt. Gox of accumulating $38 million in unfulfilled bitcoin […]

Regarding the arbitrage mentioned way above: people cashing out at Mt. Gox after buying more cheaply at bitstamp or another exchange. That could be, and probably is, a great problem for Mt. Gox. Now Mt. Gox price (as of Saturday 11:20 GMT) is $700 and Bitstamp is $716. Brilliant.

Whatever else happens, as long as Mt. Gox starts up Bitcoin withdrawals again, people will move their Bitcoins to Bitstamp et al and a) feel safe and b) if they want to cash out, cash out there.

There’s no reason this balance shouldn’t hold and Mt. Gox survive. Transfers of Bitcoins OUT of Mt. Gox would not directly affect the price. If BTC withdrawals begin again, who in their right mind will try to sell their BTC at Mt. Gox and try to cash out?

[…] an refurbish on Monday, though didn’t explain accurately what a emanate was. Over a past week, complaints about Mt. Gox’s bitcoin payout problems have robe louder as a reserve of emptied withdrawals has […]

[…] promised an update on Monday, but didn’t explain exactly what the issue was. Over the past week, complaints about Mt. Gox’s bitcoin payout problems have gown louder as the queue of unfulfilled withdrawals […]

[…] promised an update on Monday, but didn’t explain exactly what the issue was. Over the past week, complaints about Mt. Gox’s bitcoin payout problems have gown louder as the queue of unfulfilled withdrawals […]

[…] promised an update on Monday, but didn’t explain exactly what the issue was. Over the past week, complaints about Mt. Gox’s bitcoin payout problems have gown louder as the queue of unfulfilled withdrawals […]

[…] issues with numerous customers claiming they never received their bitcoins. Apparently upwards of $38 million worth of bitcoin withdrawals have gone unfulfilled causing MtGox to freeze withdrawals […]

[…] issues with numerous customers claiming they never received their bitcoins. Apparently upwards of $38 million worth of bitcoin withdrawals have gone unfulfilled causing MtGox to freeze withdrawals […]

[…] 4, 2014 – I publish my “38 million dollars missing at Gox” article, which is the first article to convert the question from a technical to a financial one, as far as […]

[…] did security processes: “It seems to run well and we don’t really care”. I have hinted in my previous posts that I’ve got stuff that would be jawdropping; I’m not sure it is […]

[…] Feb. 4, Swedish Pirate Party founder Rick Falkvinge reported that Mt. Vox had already racked up more than $38 million in unfulfilled withdrawals (i.e., Bitcoins left users’ accounts but never made it to the […]

[…] Feb. 4, Swedish Pirate Party founder Rick Falkvinge reported that Mt. Vox had already racked up more than $38 million in unfulfilled withdrawals (i.e., Bitcoins left users’ accounts but never made it to the […]

[…] Feb. 4, Swedish Pirate Party founder Rick Falkvinge reported that Mt. Vox had already racked up more than $38 million in unfulfilled withdrawals (i.e., Bitcoins left users’ accounts but never made it to the […]

[…] Feb. 4, Swedish Pirate Party founder Rick Falkvinge reported that Mt. Vox had already racked up more than $38 million in unfulfilled withdrawals (i.e., Bitcoins left users’ accounts but never made it to the […]

[…] Feb. 4, Swedish Pirate Party founder Rick Falkvinge reported that Mt. Vox had already racked up more than $ 38 million in unfulfilled withdrawals (i.e., Bitcoins left users’ accounts but never made it to the […]

[…] Feb. 4, Swedish Pirate Party founder Rick Falkvinge reported that Mt. Vox had already racked up more than $38 million in unfulfilled withdrawals (i.e., Bitcoins left users’ accounts but never made it to the […]

[…] Feb. 4, Swedish Pirate Party founder Rick Falkvinge reported that Mt. Vox had already racked up more than $38 million in unfulfilled withdrawals (i.e., Bitcoins left users’ accounts but never made it to the […]

[…] 2月4日,瑞典海盗党创始人Rick Falkvinge宣称,Mt.Vox已经积累了高达3千8百万的未提款(即,比特币离开用户账户但并未支付给用户)。 […]

Wouldn’t be surprised if this had been an attempt at further discrediting Bitcoin & throwing people off the idea. I know this was a while ago, but I just managed to see it now & I can’t help but think that it’s something like that. It could be done in so many different ways, too. I wouldn’t be surprised if the regular banks were at the root cause, since they could afford to get people to do this somehow. I’m not saying for sure, just a thought….

We stumbled over here different web page and thought

I may as well check things out. I like what I see so

i am just following you. Look forward to looking into your web page repeatedly.

Minimizing stock quantities without worrying about jeopardizing customer service values.

This is the technique the majority of us aspire to learn over time

First time here. I came across this board and I find It really useful & it helped me out a lot.

Heya i’m for the primary time here. I found this board and I find It truly useful & it helped me out much.

I hope to give something again and aid others like you helped me.

Wow, awesome weblog format! How long have you been running a blog for?

you make running a blog look easy. The total look of your website is great, as well as the

content material!

Get no-obligation mortgage pre-approval for FHA or standard financings online in concerning 10

minutes or less.

Useful post. I’ll come back here for more. Wonderful site.