Yesterday, news broke that the Expensify service has enabled bitcoin payments. With the rapidly expanding number of businesses accepting bitcoin as payment method, one could think that this was merely another player in the pool of bitcoin’s expanding economy (which just broke the one-billion-USD barrier, by the way). But Expensify is something much more than that.

Let’s first discuss the concept of expense reports to understand Expensify’s important role in the subsurface payments ecosystem. On all companies I’ve worked for lately, you don’t ask the company to buy something you need for your work – it’s just too much paperwork, too much red tape to make it happen. Instead, you get a small budget for discretionary stuff you need to do your job, and you just buy stuff as you need it with your private credit card, send in the receipts to your employer, and get reimbursed on the next paycheck, which arrives before the credit card bill is due.

This system is pervasive and ubiquitous. Sending in receipts for payment like this is known as submitting an expense report. It’s still bureaucracy and red tape and it still sucks, but it sucks considerably less than asking for approval in advance.

Enter Expensify, a service that markets itself straightforwardly as “Expense reports that don’t suck”. I’ve been using Expensify through its development for the past couple of years and have also contributed my use case (frequent travel outside of internet coverage), which led them to implement important new features – meaning, they’re a responsive bunch, too.

I don’t know anybody who submits expense reports who doesn’t use Expensify.

They have reduced the hassle from spreadsheets and forms and manual calculations down to using your phone to shooting the receipt you get as you get it, then throwing it away, forgetting about the whole deal until it’s time to press the button marked “reimburse me”, at which point that happens. Expensify saves me and people similar to me – to use a technical term – a metric fuckton of paperwork and boredom.

What this means is that Expensify is deeply integrated into the existing payments workflow at many workplaces, mine included.

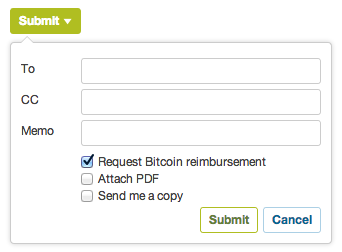

As of yesterday, Expensify added a new checkbox when summarizing photographed receipts and submitting them for reimbursement:

This is a big deal because it means that the payment processing departments of corporations are going to get a lot of requests for bitcoin payment within their existing payment workflow. It’s going to be presented – and regarded – as just another payments method alongside SWIFT, bank wire, Paypal, cash, and bank check.

Up until today, bitcoin has spread by mutual agreement between payer and payee, and to some lesser extent, by the profit pressure generated in retail from the lack of credit card processing fees. But with Expensify adding it as a payment option in a lot of companies’ existing workflows, enabling people to request payment in bitcoin in addition to bank wire and paypal, there is unilateral social pressure within an existing payments structure for the payer to use Bitcoin. This is new. Plus, the fact that the payments structure in question is bloody everywhere – especially as it’s subsurface (below the corporate level), so it changes much quicker.

Expensify adding bitcoin to its workflow gives bitcoin social virality and social, directed pressure for corporate uptake.

I’m very much looking forward to see statistics from Expensify in bitcoin use, but I expect that bitcoin pressure won’t come from the reimbursement departments, but rather from workers who request reimbursement in bitcoin (as per the image above) – particularly when being paid internationally.

To quote a tweet from yesterday: I love the fact that a geek experiment in decentralized, anonymous payments is now worth one billion USD and has come to compete with national currencies.

Bitcoin is already viral and the line between cause and effect is blurred. My projection is that Bitcoin will double its value every month until it reaches $10000-$100000. As market cap goes up the currency becomes more liquid so larger investors will be able to put their capital into it. As more capital is injected, even larger investors are able to put even more capital into it and so on. In parallel there’ll be a demand for services around Bitcoin, which will yield more attention… I don’t know how it was living around 1776 in U.S. or 1789 in France, but when I travel to work on the subway and constantly monitoring the Bitcoin ticker app on my smart phone I feel revolution every time it ticks 🙂

Dream on Datavetaren..

Hey Clocky, Datavetaren is not the only one who projects such figures. I also believe that each bitcoin will be worth a minimum of $1000 in the near future. Current figures are only the beginning.

BoF good for you but be ready for the BCcrash which surely will come soon

And as someone else says who cares what value a currency has if one cant exchange it or buy something of real value with it.

Sure, but not so near as you think. While the BTC economy is steadily growing, the tempo is nowhere as fast as the recent exchange rate boom. Expect the bubble to burst in the near time, getting back to ~25$/BTC.

Partially I predict that it will at least double every fortnight (every 2 weeks), but exponential growth charts indicate that the ‘2 weeks’ marker will shrink shorter and shorter as time goes by. But, this is highly dependent on media coverage and social/political global occurences. We shall have to wait and see, though I’ll stick with saying at least doubled within 1-2 weeks, and then every double will occur sooner than the previous, certain evolutionary stages will spike the ‘doubling’ also (quadrupling, etc, when these stages occur).

That’s awesome! Cash, no wait… computational power is king. 🙂

Hmm, if corporations still have to take the “normal” route of buying Bitcoin over sites like MtGox etc. that seems a bit tedious… and I’m not sure how many firms are going to go out of their way to change this in their policy that they actually keep buying Bitcoin as a 2nd currency to have a steady “supply” to pay off worker expenses.

On the one hand there might be lots of inertia until companies accept this possibility, but I’m not sure how much pressure this feature in Expensify can make.

There are plenty of other ways to “buy” bitcoins. The easiest for a business might be to get a coinbase.com account (ties directly to bank account with only a ~1% fee for buying) and generate paper wallets to the customer (or cash out to the specified bitcoin address if expensify allows the user to set it)

Firms don’t need to buy from MT.GOX. They can sell their goods for bitcoins

Question : if an european company is willing to pay the salary of an employee in bitcoins (even partially), how could it do it, from a legal point of view?

I don’t see this being a problem at all. The transaction could happen over any agreed-on medium and in any agreed-on currency.

Maybe even paid directly in hard wares or contracts of computational processing power. I wonder how many Hashes / Month my work would be valued at. :o)

Answer: assuming there is an agreement between the employer and the employee, they just do it. There is nothing in law that states employees must be paid in any particular currency.

Here are the problems with the bullish predictions of BitCoin at $100,000.

BitCoin can’t work as a means of payment if its value appreciates with orders of magnitude every few months. BitCoin will be turned into a speculative commodity with a very high volatility. A company with 10-20% margins can’t sell products if there is a risk that the value would plummet with 80-90% by a sudden speculative backlash.

Also, if the value goes up like this, people will just hoard BitCoin and not use it. Most of the currency stock will sit idle.

BitCoin can easily be replicated. If there are $$$$$$$$ to be made in creating a competitor, it will happen!!! The problem is to create a TorrentCoin, TradeCoin or PayCoin that will reach general circulation and be accepted. If several large players start accepting an alternative XCoin they can kick start the market for a BitCoin challenger. Once a competing XCoin reaches critical mass, more competitors will follow. This will slow down or even revert the value of BitCoin.

Dozens upon dozens have created bitcoin clones. None have gained any meaningful traction, and it does not appear that any will.

But not at 100USD each BTC. Thats what will bring competition. And the tottaly clumsy kludge BTC UI is for a public good.

Things about BitCoin that make me worry.

– Losing the wallet file is way too easy.

– What if someday the underlying crypto is broken? I haven’t studied BitCoin’s principles in-depth, and am no mathematician; but what if? Breaking BitCoin seems more probable than breaking trust and physical assets involved in current trade, including mainstream currency trade. It’s easy to fence off a region of the world that breaks the trust, or change the means of trade with that region; it’s somewhat harder to fix a single globally used swarm algorithm in case it gets broken. It’s not possible today nor in the foreseeable future; could it become possible some day?

– Governments can regulate it as easily as they regulated gold coin trade. And they did. Oh boy they regulated it to no end, and replaced it with the currencies we have today. US recently simply said “Well, businesses have to adhere to the same rules when it comes to BitCoin as with other alternative currencies”, removing one concept perceived as BC’s advantage.

– And in particular regarding this article: reimbursement via BitCoin is easy to request, but also to refuse. As much as one could unilaterally pressure the company to go through the hassle of obtaining the currency and transmitting it, so can the company reject it. I can request payment in Chinese Renminbi or the Botswana Pula, but the company will simply reject it.

It’s hard to be a believer in BitCoin until one can get paid with BitCoin, then go to a shop and purchase a loaf of bread. A particular BitCoin’s value on a particular day can indeed reach $100.000, but it’s worthless to me unless I can buy bread with it. US dollar is something I will not be actively converting into just for the sake of converting into it; I’ll be converting from US dollar into my local currency so I can buy bread. And milk.

It’s a curious idea. But BitCoin’s value is being ballooned out of proportion by speculators.

It’s easy to stamp a $100.000 price tag on a leaf of grass. That does not make the grass worth more unless there’s someone willing to exchange $100.000 for it. I suspect not many people will be willing to put real value (oil, wheat, …) behind BitCoin, no matter how phony the currently existing system is.

And going through two way lossy exchanges just to transact money in a way that will end up being trackable (“let’s see how much money is in account XYZ”)… I simply don’t have trust in BitCoin’s future or usefulness.

I’m sure people keep posting stuff like this and that it highly annoys current BitCoin users. I nonetheless felt the need to do it.

Good to see that not everybody on this site is duped and dazed by the BitCoin hype from BC-insiders like Falkvinge.

If one believes that a fairytale currency like BT will be worth 1000’s of dollars within a short period of time: Then I believe those persons who do should get a reality check ASAP.

Fairytale currency like USD or EUR you mean? Bitcoin can be understood by people with reason. USD and EUR etc has to be understood not by reason but by trust. Do you know what a checksum is?

Skog, BitCoin really is a fairytale currency as you cant buy almost anything ot real value with it and speaking of trust, would you trust a currency which is being hyped by people who calls themselves Ultracapitalists who just seem to be looking for a quick way to make some fast money.

Clocky: Ultracapitalist in the sense “nay to monopolies” & freedom to do business, small-state & low-tax kind of society where corrupted governments can’t fuck you over and steal your possessions because of established businesses (banks and corporations) lobbying to control the tax-distribution and law-enforcement mechanisms to impose market monopolies i.e. “legal rights” or lawful stealing as in the case with bank bail outs of the last financial crisis…

checksum, last I was dealing with it was sending packets, and it was a result made from all other content in the packet.. I think they’re meant to prevent general stream corruption and related, there is nothing relevant about it.

You can shop and buy anything that you’d normally buy online @ http://jobe-emporium.com/

Happy Shopping! 🙂

Well, is based on cryptography as well, so if anyone invented anything that could “break” bitcoin, it probably could break cryptography used by conventional electronic transactions of ordinary government-created currencies between banks and it’s users. So in that respect it’s no worse than todays system.

I think the loss of trust of banking and financial establishment due to the 2008-2009 crisis was large enough to provoke a power shift in economy away from banks and the obvious corruption imposing taxes on people to cover for gambling bankster maniacs’ losses.

The difference is in loss of transaction trust between institutions/clients (Solution: “until further notice, transaction requests are sent via paper”) and complete loss of account status trust (Solution: I can’t figure out any except dissolution of currency until it can be redesigned. At which point you can’t transfer the balance because you can’t trust it).

While the current currencies and the accounts based on that are not easily observable by private citizens and highly depend on trust, BitCoin has quite the opposite problem. It doesn’t exactly have the privacy and anonymity (especially if someone like Google decides to adopt it or even just look into it), the speed, the adoption, the stability… Heck, even trust. You’re depending on the underlying algorithm to be secure (I’m okay with that, I trust people that it’s secure at this point in time), and you’re depending on the rest of the network to work okay. And the rest of the network is essentially unaccountable. Individuals in the human civilization always depend on others, but in case of something as essential as our property, we want others to be accountable.

BitCoin also highly depends on a few exchanges to get access to our value (the value which, to be useful, today still must be expressed in dollars, euros, yens, et al). Exchanges which do not exactly inspire trust even based on their name. “Mt Gox”? Nomen est omen.

And sure, we could lose trust in SSL if the underlying crypto is broken. And quantum computing could theoretically be used in breaking RSA (as RSA relies on the difficulty of finding the prime factors of very large integers). See this link for a short overview:

http://stackoverflow.com/a/2768918/39974

As far as the public knows, this has not been done yet in a practical way.

But — that’s another (and primary!) problem, key phrases are “yet” and “as far as the public knows”. And if SSL is broken, we lose a “secure” communication channel. If BitCoin is broken, wealth of a nation could be in jeopardy.

I hope that breaking RSA and breaking BitCoin is indeed impossible or as far away in the future as possible. Would I be willing to bet even a single nation’s economy on that, much less the world economy? I’m not sure I would.

Oh scratch that. I’m sure. I would not. 🙂

Just responding to the question about the crypto underlying bitcoin being broken: What happens if the encryption banks use is broken? In both cases we’d simply swap to a new cryptosystem.

[…] Forrás: Falkvinge.net […]

[…] Why Expensify Endorsing Bitcoin Is A Really Big Deal: Social Virality […]

[…] Falkvinge – Why Expensify Endorsing Bitcoin is a Really Big Deal […]