With banks opening on Cyprus, many entrepreneurs realized they had been wrecked overnight by their government’s dishonesty. The so-called bank bailout was in reality a death sentence for many small businesses, who saw their operating capital confiscated to save the government’s face. This move will create an inevitable uncertainty throughout the Eurozone: who will dare put their operating capital in a bank in a troubled country, when politicians keep saying everything is fine – until one day, the money is just gone?

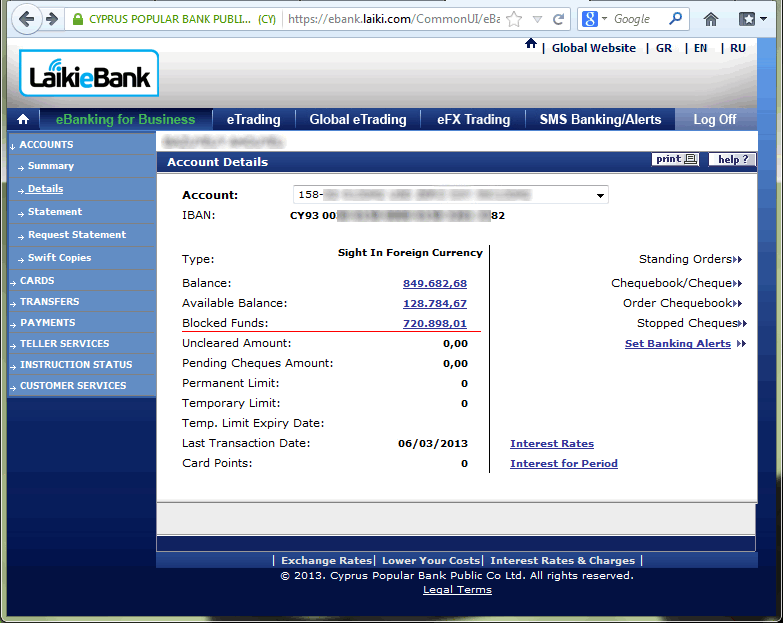

In a post this morning in the Bitcoin forums, user zeroday complains that 700,000 Euros were robbed by the European Commission. They’re not some Russian oligarch, the user writes, but a typical medium-size European IT business, and the result of this is that the entire Cypriot workforce will have to be laid off. The screenshot from the bank speaks a thousand words:

Thousands of other companies based in Cyprus are in the same situation, zeroday writes. This is not just problematic, but catastrophic on so many levels.

First, the ability for a troubled government to just go in and take money wherever it damn well pleases goes counter to pretty much every crucial principle of law – that laws need to be predictable, equal, proportional, and its rules known in advance. In this case, neither applied.

Second, the problem here isn’t so much that somebody who invests in a troubled bank goes bust with the bank. That wouldn’t be a problem in itself. The problem is that this happens despite governmental guarantees to the contrary. If governments published bank data openly so every small business in the Eurozone would be able to judge the solvency of their banking partner and make proper risk assessments, this would be proper, and it would be tough but just if a bank went insolvent and its accounts were closed to cover the losses.

But governments keep insisting that this is never going to happen, until it just did. Then, governments go back into denial mode that it will never happen again, with a “would I lie to you twice?” face plastered on, expecting to be believed.

This sends a very clear message to small Eurobusinesses across all of Europe: “governments cannot be trusted when guaranteeing your money in the bank, and you may be next if you keep trusting European governments”. In particular, I expect small businesses in Spain, Portugal, Ireland, Greece, Italy, and France to start relocating their operating capital out of the Eurozone, come the very first weekday after Easter.

Zeroday writes further,

We are moving to small Caribbean country where authorities have more respect for people’s assets. Also, we are thinking about using Bitcoin to pay wages and for payments between our partners.

I expect many, many small Eurozone business to do the exact same thing, after seeing this bank screenshot. Reading about it in the news is one thing. Seeing exactly what happened to this small entrepreneur is another, and realizing that this may be your bank screen tomorrow.

This was the death of the small Eurobusiness climate. At the same time, it was not just the end of the beginning of the Euro, but also the beginning of the endgame.

What we learn from this is that the transparency that would have been necessary at the Euro’s conception is still denied the public at large by banks and governments, and that this lack of transparency brings nothing good at all. Small Eurobusinesses are now dying and not coming back to the Euro, and for very good reason.

You are quite right, Rick!

This is pure theft, and outrageous… it also exposes the IMF and central bankster system for what they truly are, thievery corporations.

On the spot!

But tell me, if authorities don’t catch the thieves, could we shoot them?

Thieves shouldn’t be shot no matter how good it may feel, or how right it may seem. That’s treating the symptoms only.

What should be done, is ending the thievery that comes from greed.

What better way of ending the thievery, than just shooting the thieves? That’s not treating the symptoms. That’s treating it right at the cause, the cause being that the thieves feel safe from punishment.

Sickening to see.

It’s a stark reminder that “your money in the bank” isn’t really that at all – it’s a loan that you have made to the bank, and they can default on it whenever they see fit.

But yes, Euro-based commerce is dead and so is the Euro. What a joke that they thought it would rival the dollar.

If you have some money in the bank and thinking of buying a new car then do buy a new car next week!

Or, even better, buy an asset, not a liability!

Just read some basic Kiyosaki man! 🙂

What a load of b.s. Where is the -1 button?

It wasn’t the s.c. troika that decided to limit cash withdrawal to €300. That was the government that the people of Cyprus elected a short while ago.

It wasn’t the EU that decide to declare an insolvent Laika bank … bankrupt. It was (well, I’m not sure of the exact order) the bank itself, it’s creditors, or (again) the local government.

Jan, the bankruptcy of Laiki was quietly announced by the rating agencies on 26 March as ” D” -Default. Two banks, JP. Morgan Chase and Deutsche Bank made a killing from the default. It is alleged that Angela Merkel was paid € 3m commission for engineering the credit event. You must realise the absolute and total corruption of most politicians.

The Orthodox Church in Cyprus lost €100m in the bankruptcy. This is Widows and Orphans, not Russian Oligarchs.

President Anastadiades has been complicit in this crime from the day it was envisioned by the Troika.

Please come to Cyprus and you will see a country that has been absolutely shellshocked. This Financial Armageddon will be visited on other countries – a credit boom is the creation of money from nothing, like the Big Bang. During a recession, all the money that materialised from nothing, disapppears like the Big Crunch.

no church should have €100m to begin with, so no big loss there

Certainly no religious organization needs that kind of capitol, when we can all depend on the governments to care properly and fairly for our poor and needy.

It’s well known that governments are far more efficient and responsible with taxpayer’s money than any religious or private organizations are with their donors’ and investors’ money.

So I’m trying to figure out what Rick thinks should have been done differently and how it would have helped the unlucky person with the screenshot. Here’s what I’m getting:

1) He thinks the government of Cyprus should have been clearer that when it said it would guarantee up to 100k, it wasn’t going to guarantee any more than that.

2) He thinks there should have been more information about the state of Laiki so that people knew sooner that they were putting money in a bank that couldn’t pay it back.

These sound like good ideas in principle (although they may cause more bank runs) but would they really have done anything for this guy? It’s not as if Laiki’s situation was secret. I suppose people expected Northern European taxpayers would cough up, but it’s not clear that they had a right to expect that.

I think the bank should be required to warn its users of failing liquidity like other companies. If that causes a bank run, they should not have failed the liquidity and/or solvency in the first place.

I think the bank should file for bankruptcy like other companies. When this happens, and only then, should insurances kick in.

I don’t think governments, the IMF, the ECB, and others should get to decide who gets to keep their money who don’t and how behind closed doors.

Cheers,

Rick

That sounds good to me in principle, but let’s game out how it would have worked for zeroday, the guy with the screenshot.

There would have been one day when the bank’s assets got hit in the markets, and it would have to announce it was insolvent. That would have caused a run on the bank, and all but the quickest would then be unable to touch any of the money in their account, if the bank’s website was even still up.

Eventually the bankruptcy proceedings would have gone through and he’d have hopefully got the payout from the government for the first 100 K (if the EU/IMF were prepared to help them pay for it), and presumably lost everything else, or close to it.

I can see the case for having more a transparent process here that’s less liable to be gamed by potentially corrupt insiders, but zeroday’s experience doesn’t seem like a very good hook to hang an argument for that on, because it sounds like he’d have got screwed even worse than he already has.

In case of a proper bankruptcy there would be no bank run. All payments would stop, the bank’s assets would be liquidated, and the remains would be shared between the creditors according to bankruptcy law.

But this is not what is happening here. Instead arbitrary and illegal rules are made up. Rules saying that some creditors – like the government and financial institutions – should incur absolutely no losses. But this means that all losses are put on savers and businesses like zeroday. Had zeroday been a bank, he would have had no loss at all!

http://www.centralbank.gov.cy/nqcontent.cfm?a_id=12631

This is outright theft. And it will likely happen to savers and businesses in Greece, Italy, Spain, Portugal and Ireland during the next few years, if depositors are stupid enough to believe that their money are safe in the banking system..

That’s what uninsured deposit means – it’s not insured. You put your money in a crappy bank in order to pay less tax and get higher interest on your deposit, you’re taking greater risk. Some people get out early and win and some lose. It’s called capitalism.

You’re absolutely right. It’s just a shame that the present-day monetary and banking system has very little to do with capitalism.

Except that these days EVERY bank is crappy, and the crappiness is enforced by law. Good luck trying to find a better bank…

So, let me get this straight. Am I supposed to feel sympathetic for a company that went to Cyprus because they wanted to “cheat” the fiscal system and now they are moving to a Caribbean country for the same reasons? I’m actually glad they lost money, and I hope this will happen to all other companies that think the same way.

@ShadowRider – When they come for your money (assuming you’re totally legit in all your financial matters), will you still be ‘unsympathetic’ when a chunk gets taken straight away and most of the rest is frozen and withheld from you. Going to still be ‘glad’ that your money has been taken. And if you don’t have hardly any money, will you be ‘glad’ when the company/business you work for sacks you because they can’t pay your wages anymore?

Do you think others in other countries will be ‘glad’ that you’ve lost your money and your job?

I totally agree with ShadowRider. Rick, is it now ok to cheat your country for taxes? EU raid on offshore havens is a good thing!

Following every rule in the book is not, and was never, “cheating”. This is not a raid on tax evaders. This is a confiscation of funds that is rather unlikely to stand up if challenged in court – but by then, it will be far too late for the killed small companies.

Perhaps next time nothing should be done. That way, at least, there couldn’t be complaints of confiscation, but of evaporation.

These people took a risk in order to get better terms and now that risk is coming back to bite them. Too bad. I hope the same happens in the next tax shelter they use.

Incidentally, yes, this is what the Cypriot govt should have done and this is what Rick is correctly blaming htme for: in order to “save their face” they have killed off the businesses in Cyprus. Please do note it is not only European firms, but also local Cypriot companies that have lost their operating capital. The economy is dead and buried.

A simple “get shafted” to the EU, followed by a sovereign default would be a much shorter and efficient way out of the crises. But of course, the local politicians – and European banks – prefer to put Cyprus into the same state of economic coma as they’ve done with Greece or Spain.

From where I stand (Slovenia), Cyprus is second name for money loundering, bypass companies, tax evasion and alike. I do not support bailouts, I’d rather see banks go bankrupt, to make that clear. Yet bailout is actually helping Cyprus based companies, much better than total bankrupcy, is it?

The argument of tax evasion is not really a good one in this context, since the tax-money just gets poured to fill out the banksters debts after every new financial “crisis” anyway.

this shows the lack of respect and concern for the people. banks can take peoples money when they want for as long as they want for whatever purpose they want, and not be held accountable, let alone be forced to pay it back. just try to get away with not paying whatever it is a bank says you owe to it. not a chance in hell! and after all that has happened here, the banks workers are still being paid massive bonuses! Merkel is still telling every other EU country what can and cant be done, by whom and when! this whole ‘world financial crisis’ was orchestrated by governments because they were too worried that they were losing control abd people were getting information as to what was happening in governments and big business. once it couldn’t be hidden any more, a new plan had to be devised. if this is not the case, tell me why it is that almost every country is suffering from the same problems and doing the same things, taking the same steps to ‘combat’ the problems. i cannot believe that every country has been hit in exactly the same way by exactly the same things. it’s all a put up job, to keep the rich just as rich, the poor even more poor and to put the rich back in control!

I’m curious about the specified last transaction date – since it states that it is 6/3/2013, I’m wondering if this screenshot is accurate because that date is more than 2 months in the future. Could you please clarify? Thank you.

Last transaction date was on the 6th of march.

6th of March not 3rd of June. Europeans write the date in the dd/mm/yy format.

Actually yy/mm/dd is also acceptable in civilised and developed parts of Europe…as it should be, it is an ISO-standard after all not to mention SCI/IUPAC-standard.

mm/dd/yy is just stupid, might as well type md/my/yd…

http://xkcd.com/1179/

[…] och demokratiskt parti som svarar på alla frågor: såväl de traditionella vård-skola-omsorg-ekonomi-områdena, som de framtidsfrågor som dagens partier knappt tänkt […]

Haven’t Rick made a big mistake? The money that have been blocked. Is probably not the companys own money but funds loaned to them by the bank. Who now needs them back on short notice, not fun for the company but something which is fully legal and according to the terms of such loans.

No.

According to the “resolution measures” (the rules they just made up to give special treatment to some creditors – exactly what bankruptcy law was created to safeguard against), customers who borrowed money from Laiki Bank and have no significant deposits there will simply be moved to Bank of Cyprus without having to pay back the money before originally planned.

http://www.centralbank.gov.cy/nqcontent.cfm?a_id=12631

Remember that loans are assets on the balance sheet of a bank. This is how they make money. By making up an arbitrary rule that the assets are to be moved out of the bad bank, the losses to savers and businesses like this company will be significantly bigger than if Laiki Bank had gone through an ordinary bankruptcy.

There is too little details about this guys account and business so I should be careful to draw the conclusions thst you and Rick have done.

[…] och demokratiskt parti som svarar på alla frågor: såväl de traditionella vård-skola-omsorg-ekonomi-områdena, som de framtidsfrågor som dagens partier knappt tänkt […]

It occurs to me that there should be two public votes every year. One for who is in office and one for and increases in funding the government wants.

[…] och demokratiskt parti som svarar på alla frågor: såväl de traditionella vård-skola-omsorg-ekonomi-områdena, som de framtidsfrågor som dagens partier knappt tänkt […]

[…] Death Of The Small Eurobusiness, In A Bank Screenshot […]

FYI: US law enforcement envisions 30.000 HDTV spy drones to film everyone – all the time.

http://www.youtube.com/watch?feature=player_embedded&v=EKWi6aVV_EA

Hi, I’m zeroday from bitcointalk, the owner of business ruined by Eurogroup’s decision to loot private bank accounts in Cyprus.

We started the business in 2001, before Cyprus joined EU, and everything was going smooth, we worked hard to keep our company successful and profitable. But happy days ended on March 16 when all banks were closed countrywide and few days later the most of our assets were confiscated. We didn’t have loans or credits, everything on the bank account belonged to us or our customers who made prepayments.

I often see comments on my topic, saying that everybody in Cyprus deserve this because we avoid taxes and “cheat the country”. I find such statements outrageous because I run my business in full compliance with law! If law gives me ability to minimize taxes, I do that as it is my right.

Treacherous politicians always do their best to justify their actions in the public eye. This time Merkel says “we are going to punish oligarch and tax evaders” and entire country is sacrificed to feed greedy EU Elite. Ironically, all the real oligarchs wired their money out of Cyprus a day before banks closed. In reality, only small business capitals or people’s life savings were taken to repay country’s debt. Mafiosos not affected.

There are thousands of companies similarly hit, and sadly my business is also one of them. Unfortunately the whole world buys the “it’s only russian mafiosos” bull. Our income was 100% legal and taxed. I wish they would at least run an investigation for the sources of the money that went into those banks. This has essentially killed our business , as well as many others i think.

What’s worse, there doesn’t seem to be any banking system that is safe in the south of europe. Unfortunately, the only way out is to immigrate or just give up.

[…] had 850.000 euro, waarvan nu 720.000 euro geblokkeerd staat (zie: eerste bron, bron 2 en bron 3). Klaar om doorgestort te worden naar het zwarte gat van de Cypriotische […]