These past days, I have done a lot of thinking about bitcoin that ended up with me investing all of the money I had saved and all that I can borrow into the currency. Here’s why.

In two posts now, I have considered the effects of bitcoin on society. A lot of more thinking has been done than has been described in writing, and it has resulted in me putting all my savings into this currency.

Short version of what bitcoin is: it is a currency, but an entirely new kind of currency that can’t be seized or frozen by governments, one which is integrated with its transaction system where transaction fees are optional, and where you can transfer any amount anywhere instantly without any authority knowing or interfering.

I will demonstrate how it is used a bit further down in this article.

Here are the three key reasons I bet on bitcoin:

Past performance: the currency has increased in value one-thousandfold against the US dollar in fourteen months. Yes. Read that again: one-thousandfold, fourteen months. There is currently no indication it would stop or has saturated; quite the opposite.

Use case: the key advantage for bitcoin is that it does away with all bureaucracy, all transaction fees, and perhaps foremost, all transaction delays and gatekeepers in the financial system.

Key uptake drivers: doing the math, I predict that it has at least another thousandfold increase to go in the coming few years, and that’s counting conservatively.

If calling this article “financial advice” could make Falkvinge legally liable in your jurisdiction, then this is not financial advice. If it could be construed as something else that would make Falkvinge liable, then it is not that, either. Rather, it is a description of a thought process.

Let’s look at these three considered factors one at a time.

1. Past Performance of Bitcoin

Normal currencies vary by a few percent over the course of a year. Not bitcoin. On March 30 of last year, somebody asked for $50 for 10,000 BTC (bitcoin) in the trading and wasn’t taken up on the offer. He got an offer of $25. Still, somebody claimed in the thread that the going rate was about USD 6,50 per thousand bitcoin. That’s per thousand. So while there are conflicting numbers between $2,50 and $6,50 as the rate for 1,000 BTC, let’s be conservative and go with the higher $6,50 per thousand BTC and compare it to today. As of midnight UTC on May 29, 2011, the rate is USD 8,30 per bitcoin.

In the past month, the value has tenfolded.

In the past three months, the value has hundredfolded.

In the past fourteen months, the value has more than thousandfolded.

This can be hard to grasp. If you had changed 2,500 euros into bitcoin last spring, they would be worth more than two point five million euros today.

I challenge you to find one other commodity with this pace of appreciation. And there’s no indication it’s slowing down or saturating. Quite to the contrary: interest is picking up. It was only yesterday that the first article in mainstream media in Sweden was posted. (It sounded a bit like when the Internet was first presented: “thousands of people and shops are turning to a new digital currency…”)

Now, past performance is no guarantee of future performance. But I’ll be returning to that.

2. How Bitcoin Is Used

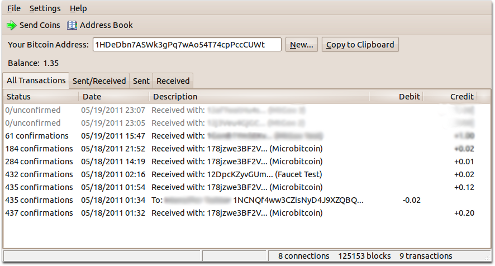

Bitcoin looks pretty much like any other computer program. It can be installed from bitcoin.org and is available for Windows, Mac, and Linux. If you didn’t know the underlying differences, you might think you were looking at your bank account. But you’re not connected to any bank — you’re connected to the bitcoin network, and what you are looking at is the money you have in a file on your computer, and only on your computer.

As long as you have this file, nobody can seize your money. Or look at your account balance, for that matter. You can make copies of the file. It is very wise to make copies, encrypt the copies, and store encrypted copies in many places. The money is in the file, in the form of cryptographic signatures recognized by the bitcoin network. (Copying the file doesn’t give you twice the money, but losing the cryptographic signatures will make you lose the money.)

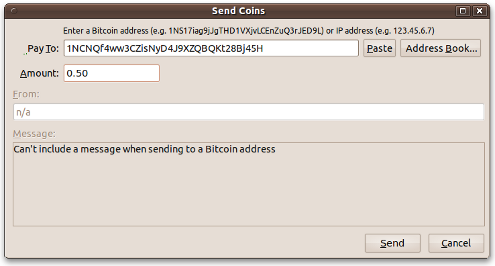

So let’s say I want to transfer money to a friend in New Zealand. I hit Send Coins above, and enter my friend’s bitcoin address. In this case, I am picking it from the address book. I am choosing to send half a coin, roughly the price of a cup of coffee today.

As I hit Send, which I did right after taking this screenshot, my friend in New Zealand got this coffee money instantly, and it was deducted from my balance.

Sounds easy and straightforward, doesn’t it? It sounds just too easy. So just to illustrate, let’s take a look at all the normal things that didn’t happen:

- Nobody logged on to a bank of any kind.

- No bank page for complicated foreign transactions was loaded into any browser.

- No expensive foreign transfer fees were applied. In fact, no transfer fees were applied at all.

- No banks were holding on to the money for a couple of days. My friend had the money instantly.

- No bank holidays were relevant. I did this on a Sunday.

- No governmental economic blacklist was consulted. He could be a criminal under New Zealand law for all I care, but what matters to me is that he is my friend.

- Nobody got the chance to seize the money before my friend in New Zealand got it. Or afterwards.

- An alternative to a bank transfer would have been to use Visa or MasterCard. They did not get a cut, either.

- No tax authority saw the transaction or the money.

In fact, nobody knows that he got it except me and him. And he doesn’t know who sent it to him; he only sees the address he received it at. He’s probably a bit confused or surprised right now.

It’s not hard to see how this will replace the current financial systems, is it?

Of course, my friend doesn’t have to be in New Zealand. Just like when mobile phones arrived, I don’t have to know where he is, or care, for that matter. He could be on the other side of the planet, right here in Sweden, in Southeast Asia, or on the Space Station in low Earth orbit. It doesn’t matter. All I need is a bitcoin address and a net connection, as does he.

So why don’t you try installing the software? Then go to this page to get two bitcents for free, just to try it out.

3. The Key Uptake Drivers

So why am I so certain that the value will continue to grow? So certain that I bet all of my own money on it?

The supply of bitcoin is limited, and on a timescale of years, it is fairly constant. Nobody will issue more bitcoin to meet demand. This means that as more people exchange national currencies for bitcoin, the value of one bitcoin rises.

Usually, financial analysis is driven by financial analysts. This is something as unusual as a financial analysis from a civil liberties perspective.

To safeguard fundamental civil liberties for the entire population, the best bet is to guarantee the liberties for those who barely deserve it. The bottom of the barrel. But human rights do apply to all humans. If you manage to guarantee rights to the people who are despised, you have also guaranteed it for everybody else.

And in this case, it is just like that — it is the bottom of the barrel who are going to secure civil liberties for the rest of us with regards to our own money.

There is currently about USD 50 million in the bitcoin system, and just over six million coins in circulation, valued at $8 each. Up until now, demand has largely been driven by enthusiasts.

The value of a bitcoin can’t be held constant — if 12 more million dollars is exchanged into bitcoin, the value of a coin will rise to $10. The more people who want to use the system, the more people will need to exchange a portion of national currency for bitcoin, and the more money will go into the system. The more money there is in the system, the more a single bitcoin will be worth.

(UPDATE: As has been pointed out, the above paragraph is a simplification of the mechanics of a market.)

Some people have ridiculed the bitcoin currency because you can’t use it to buy a hot dog on the corner. The legacy banking system is much more suited to everyday tasks due to inertia and the networking effect. In this observation, they are entirely correct, and yet they are but a millimeter in that observation from drawing the conclusion why the uptake and value of bitcoin will skyrocket once people understand just how revolutionary it is:

The secondary uptake wave after enthusiasts is not going to come from those who use legacy banking daily and are comfortable with it. It is going to be people who don’t want or are not allowed to use the legacy banking system for their everyday transactions.

The total money supply in the world is about 75 trillion US dollars. It varies a bit daily with currency fluctuations, but it’s on that order. Estimates say that between 5% and 30% of this supply is in the black market with illicit work and services. Let’s be conservative and pick 5%; let’s assume cautiously that four trillion US dollars worldwide is in the black market.

Most of this is arguably with local small-scale services — a craftsman who repairs your lawnmower and doesn’t give a receipt, an unlicensed taxi driver — but using the law of uneven distribution, we can assume that about 10% of this underground economy is of the large-volume high-tech variant. You know, the kind of economy that is capable of building undetectable submarines to smuggle narcotics, submarines so advanced that the US Navy isn’t able to detect them.

Let’s assume, again conservatively, that these high-tech operations shift 15% of their monetary transactions into this undetectable and untrackable financial system over the coming years, to try it out. That brings us to 15% out of 10% out of four trillion USD, coming to 60 billion USD that will enter the bitcoin system in cautious estimates.

The use case is undeniably compelling. But 60 billion USD that enters the bitcoin system in the coming years means that the value of a bitcoin will increase another thousandfold: the value of the system in total as of today is about 50 million USD.

At that rate, the money for a cup of coffee I sent above has become enough to buy a nice car instead.

Of course, this number assumes that nobody in Wall Street is greedy enough to want in on the value skyrocketing of bitcoin. In the real world, I am expecting investors to pump in more money into the system just to get their own share of that value increase. The sharks on Wall Street positively jump at the opportunity of seeing a 25% increase in their portfolio; we’re talking about a 100,000% increase here. Therefore, money from Wall Street and other investors will also boost the bitcoin rate at a proportion I’m not prepared to guess.

These two combined are likely to drive the uptake of bitcoin into normal daily commerce in a tertiary wave. Webshops first, then the physical world.

That’s why I’m putting all my savings into bitcoin now. In a best-case scenario, those savings can get three more zeroes after them in three to four years, based on these numbers.

4. Threats

I can bet a good deal of money that banks and credit card companies will lobby to have bitcoin outlawed, using whatever reasons they can dream up, as this technology makes them obsolete. But bitcoin is a peer-to-peer network. We have seen in the past twelve years how easy it is to shut down such networks, and governments stand to make as much a fool of themselves as the record industry did, if they go down that route.

I don’t think the prospect of looking like fools is going to scare many politicians, though. They’re kind of used to doing that. In any case, they’ll succeed about as well as the record industry did, i.e. not at all.

A more serious threat would be if somebody discovered a cryptographic weakness in the bitcoin network that allowed them to forge money. While the network appears resilient to this — the entire network is aware of the entire money supply, so you can’t pretend you have fake money and successfully pass it off — only time will tell if it really is. Until then, it is undeniably a bit of a risk. But it is one I am very prepared to take, given the potential payoff.

(UPDATE: As has been pointed out, an alternate threat is a competing cryptocurrency. But that’s not really a threat to cryptocurrencies as such; it may also strengthen the networking effect as long as there is interoperability.)

5. How To Buy Bitcoin

It’s a bit tricky to buy bitcoin. MasterCard and Visa are not very cooperative and refuse to service merchants who trade in bitcoin. It seems they don’t like it. (We file this fact under “No shit, Sherlock.“) But it can be bought anonymously.

Most people trade on an exchange known as MtGox, at mtgox.com. You can register a trading account anonymously there and buy bitcoin from equally anonymous sellers. But in order to get national currency into your account, you need to make a bank transfer to MtGox. I’ve done it using euro-based transfers. It’s annoying as the banks hold on to the money for a couple of days (bitcoin, anyone?) but the USD do end up in my trading account, and I am notified when this has happened. It works well.

The one annoyance may be that I am not allowed to transfer more than $1,000 worth of bitcoin per day to my computer from the exchange, due to US regulations. So I’ll have to transfer my portfolio in portions to my own computer in 24-hour cycles. But once that is done, they’re under my control. (Some other people may prefer to keep the bitcoin on the exchange. That would be their choice, and has its own set of risks.)

6. Finally, a Plea to the Developers

Bitcoin has appreciated like crazy, and as described, I predict it will continue to do so. There are already eight decimal places in the system. Please make it possible to use milli- and microbitcoins as soon as possible; bitcoin will continue to climb like crazy and may even accelerate. A currency where the smallest unit can buy you a small house is not practical for everyday use.

I would like to be able to use millicoins and microcoins. I know the system can handle it down to 1/100 of a microcoin; please make it possible in the interface as well.

This is an article on bitcoin. You may also want to read my first thoughts where I called this The Napster of Banking, and my analysis of how it impacts welfare and taxing.

You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

OK, if I am a big bank and want to destroy this upcoming danger to my global dominance I just need to buy ALL bitcoins that will ever be generated and never sell them again. Should be cheap enough. What happens then? Will you keep your bitcoins until the end of time?

By buying all bitcoins available, the only thing that would happen is that the value of bitcoins will increase alot, until you can’t afford more. Buying all bitcoins is also a stupid idea because a new bitcoin network to be filled with new bitcoins can be created instantly, and that doesn’t cost anything.

by you’re own fact that “new bitcoin networks with new bitcoins can be created instantly, and that doesn’t cost anything.” Will be the same reason why bitcoin will first have to become less valuable. If anyone, anywhere can create, then where is the value?

Jacob Hallén

May 29, 2011 – 23:59

Bitcoin is a defationary currency by construction.. I I got ahold of some, I would keep them and spend my USD/SEK/EUR instead. There is a risk of Bitcoin being highly illiquid.

However, I think that the biggest threat is the possible success of Bitcoin. Should it become popular and useful, it will be outlawed in all nations. Punishments for holding Bitcoin will be at the level of printing your own money. Governments will use their monopoly on violence to protect their monopoly on minting currency. Otherwise the core power of governments will go away.

While you can possibly persuade governments not to do house searches for copied music, this will not be the case for alternative currencies. No effort will be spared in asserting government control over national finances. As long as the alternative currency stays fringe (like Canadian Tyre money for instance), it can be tolerated, but as soon as it empowers people to circumvent taxation, money laundering prevention or gives people the ability to send money internationally without government control, you will have the authorities coming down on you like a ton of bricks.

RESPOND TO THIS

62.1

Rick Falkvinge

May 30, 2011 – 00:05

Absolutely. In this scenario, it’s going to be as close as you can get to an all-out civil war between the taxers and the taxees, and be very interesting.

I wrote more about this in my first post in the subject, “the Napster of Banking”.

Of course, if politicians are able to read the writing on the wall, they are going to adjust the taxation base right away so that cryptocurrencies aren’t going to hurt the nation’s tax revenues. Just like they have already acted sensibly with other P2P technologies and embraced change… or not.

But is it a given that the taxers will win, even with their monopoly on violence? Not necessarily. It depends on being able to focus your forces on specific offenders — if a large enough portion of the population is doing something, the police force isn’t effective other than as a deterrent in creating examples.

RESPOND TO THIS

62.1.1

Rebel Nimrod

December 7, 2013 – 07:02

READ THIS PART. The rest is irrelevant.

Doesn’t it seem relativly stupid to wage an all out war against the bankers?!

Dividing their efforts against it/us, only advertises means for martial law.

(Which in my opinion is the general purpose of the CIA for BTC anyway.)

There is a reason pirates don’t sail the seas anymore, so stop the RPG, eyepatch.

and don’t get things started on soma-pirates, useless argument.

That’s like polish abductions where I come from,

they place a baby terence doll on the side of the road,

wait for you to stop the car and they heist your car,

while smashing in your face with a hammer.

Nothing elegant, and basicly a gamble, so cruel,

you’d have to be starving for months to resort to such atrocities.

(Been there, had other plans though)

To avoid such problems eventually comes down to stop being human,

or driving cars alltogether… It’s not a question of solving one crime,

it’s about solving the roots of these evils.

Bitcoins?

It’s a provocative move, made by a suicidal maniac,

with no regards to human decency, fueling an ever more corrupting system,

which would be better of without monetary systems,

if it was only common sense to you all.

If you don’t want to feel inclined towards moral guilt,

and being pursued by “men in black”.

Start wearing those tin-foils and use your mind.

I read something stating, if it sounds too good to be true..

Well, Believe it, it’s too good to be true.

End of story.

And besides, I’m a mathmetician and cryptographer doing

excessive research, i didn’t even (ever) hear off this crap until a week ago,

it took my 4 hours reading official forums and this debate to conclude the following. (Btw. this tech is so outdated already… really)

((they just don’t teach you anything high end))

No matter where it peaks, and what amounts of money it makes you.

Eventually a quick decline in services will appear,

due to legal persecution of tax-dodging.

Since it can’t be centralized, it will never be fully accepted,

putting money in this pyramid scheme,

will eventually come down to supporting a temporary peak,

in the criminal network. (and yes, all currency is the same really. Clever)

Somewhat similar fact, (you are allowed to hate me, your “rights”)

Don’t support homo-sexual churches, just because they all stick

together. They won’t bring forth healthy children,

and they will spread filth, disease and moral confusion,

just because they want to be different and embraced for who they are.

Homosexueals belong in the closet, like all normal perverts,

Criminals belong underground, wether living or dead. (Not judging them..)

Bitcoins will never truly see the light of day in the mainstream west,

unless it’s as supposed (by me), a CIA scheme to impose martial law.

Then the results be even worse, hyperdeflation is a joke,

it’s not how the hidden hand works, just telling you this, trust me on this.

BTC? It’s Hitting the surface, calling out terrorsits,

and using the new mathematica wolfram alpha to gather information,

on all you uninterested, dumbed down people.

just to get a fully statistical database on all of you (who can’t see the truth),

it’s staring you straight in the eye as we speak.

Didn’t you notice the recent changes on the web?

Youtube, project free tv, just two mainstream examples.

Listen to Richard Stallman, you should be throwing your smartphones

out of the window, stop posting on facebook,

and most off all. Sell any electronical device that is not protected securly,

demand better equipment for your labour and efforts.

This year, files of Interpol, banks everything got “accidently”

stolen due to security issues… OR just remote controlled unsecured servers.

Which reminds me of the nuclear standard in the early days,

the password was supposedly 000000000, which could’ve started

an all out nuclear war in the cold war, which offcourse was a

sockpuppet war, both partnered since the fall of the tzar.

To impose a one world government in the end…

Destroying all sovereignity all over the world.

Offcourse there was no risk to start with,

they want you to know they are in complete control.

Just don’t be to loud and complete about it.

So that history is written the way the need it to be written.

That is, offcourse, (logical to me) in a machiavellian scheme.

People please, do some homework.

Screw chasing money, just make sure you got food on your table,

that your ahead of times, and keep the internet up, open and uncensored.

This BiTCh is not a revolution, it’s a scam. The only real revolution,

is the internet, connecting people. And we shouldn’t have to resort,

to spiritual enlightenment, like we’re hiding the truth in an age of emanation.

We have an english bible, and don’t have to wait for green lights.

Our ancestors paved a way of corpses fighting for this,

and you’re debating like allknowing creatures, missing the whole clue given…

You’re going to get raped by your own apocalyptic revelations.

You will be sad and demoralized in the end, simply accepting slavery.

The way they need you to be.

We’re one people of the same earth, under the sun

Don’t believe in promises of limitless heavens.

Just be there for one another, and fight those who defy that.

Amen

Btw. I don’t believe in any god.

Just like I don’t believe in a just emporer of the empire.

They all deserve inhuman treatment.

Unfair trials and torture to commit to the truth,

right before their head gets impaled on a spear.

And their “officers” hung at the edge of town.

The same they’d do to me, and I don’t care.

I’m not scared, at least not anymore since they’re activly pursuing me anyway..

My death is imminent, don’t wait till it’s too late for you.

One love! Keep the fight alive, and look the arrogant “believers” in the eye,

they don’t respect you, they won’t explain cause they don’t want to know,

and they will allways mock you with a sideways grin on their smug faces.

Dividing you against each other. In pretence of half-ass logics,

they have no heart, only those words they emit to cling to,

which they copied from others anyway..

The only reason I’m not naming myself here,

is because you would only hype shit that’s already hitting the fan,

the CIA knows who I am anyway.

I’m a barbarian at the gates.

I won’t be a fool dying for false beliefs.

And I don’t care about martyrship either.

Any man, alone, can change the whole of humanity,

if he so pleases and pursues that path.

opportunities will be presented.

The people do adore fighters.

Especially open and honest ones.

Willing to die as the heroes they truly are.

Don’t get demoralized, make your own decisions.

Fight for YOUR “SELF”, you don’t need to remain dependant.

It’s easy really, just accept, look for and find the truths,

here’s a good start. Consider it their arrogance,

and my warning to you.

http://www.youtube.com/watch?v=owGEpJ1F7-o

This is just a warning for all the euphorized people that do not have a clue about what is goig on here: DO NOT invest big money in bitcoin now – the software is FULL OF BUGS, the client does not even encrypt your wallet and in no time “steal bitcoin wallet” will be a standard feature of any malware. Heck, the whole system is still so beta, it will be overrun by cyber mafia in no time,

An article like this one is the big honeypot many guys have only been waiting for to bait the clueless newbies – we will see many bitcoin incidents in near future.

If you really want to invest in bitcoin, you should do it like this::

Do not use a commercial operating sytem like MAC or WINDOWS, both are full of holes, use an encrypted linux or bsd machine – if you do not know how to do that, leave it alone. Do not install any not-free software on that machine – no flash, no java, no other gimmicks. Best to use a LIVE-CD of a Linux System.

Use TWO different wallets, or even more. Generate a “vault” wallet and put it away in a safe (real safe!). Use the other wallet for day-to-day transactions and from time to time send bitcoins to the vault address – years from now, when you need to access your savings, retrieve the wallet file from the safe. Once the whole blockchain is loaded, your coins will be waiting for you..

It was shown in the past, that online banking with several security precautions was not safe enough. It is absolutely irresponsible to release a “cryptocurrency” with a client software, that not even encrypts your “money” you ave on your machine – if any real bank has produced such a software, the whole internet would have been laughing at them beeing extremely lame – but no, because it is “cool geeks” they are allowed to release things that have zero security built in and people are following like stupid.

Bitcoin as an idea might be interesting, the software however is definitely not trustable at the moment, it is far away from beeing usable with real values – there are simply not enough ressources put into development and developers seem not to have too much knowledge of how to develop secure systems, just look at the code…

Do not use a commercial operating sytem like MAC or WINDOWS, both are full of holes, use an encrypted linux or bsd machine – if you do not know how to do that, leave it alone. Do not install any not-free software on that machine – no flash, no java, no other gimmicks. Best to use a LIVE-CD of a Linux System. Use TWO different wallets, or even more. Generate a “vault” wallet and put it away in a safe (real safe!). Use the other wallet for day-to-day transactions and from time to time send bitcoins to the vault address – years from now, when you need to access your savings, retrieve the wallet file from the safe. Once the whole blockchain is loaded, your coins will be waiting for you..

The people who feel inspired by this post should note very carefully that these are best practices, and that I follow them to the letter for a reason.

Mafia lapdog speaking…

“best of practices”

It’s retarded really.

Did your bank account ever need to be “Split up”.

then divided over multiple banks to be safe…

Not really.

And NO, I don’t like banks and bankers and money,

and definatly not bitcoins. It’s a share in the criminal industry,

but worse, It’s already controlled by intelligence agencies over the world. Another DUD for worldwide revolutions.

As is all monetary redistribution of wealth.

Get back to watching your One Piece episodes,

sad advertiser. Come and get me if you got something to say.

Your the newb headhunter, only thing worse than this btc shit,

is a pirate party…

“the software is FULL OF BUGS”

Which?

“if any real bank has produced such a software, the whole internet would have been laughing at them beeing extremely lame – but no, because it is “cool geeks” they are allowed to release things that have zero security built in and people are following like stupid.”

Banks shouldn’t produce anything. Having a company that is both a bank and a software publisher calls for a really bad vendor lock-in. If a bank (or “real bank” as you call it) produces anything, then it would be a miracle if it wasn’t tied to a single method for authentication and encryption that cannot be replaced, no matter how insecure or inconvenient it is. Cool geeks make software that does one thing well and leaves other tasks to other software. Integration with various encryption software would be a good thing. I currently use Bitcoin with ecryptfs and make backups with GNU Privacy Guard.

“there are simply not enough ressources put into development and developers seem not to have too much knowledge of how to develop secure systems, just look at the code…”

Just look at the code yourself and say something that means something instead of just FUD.

The language you are using can be understood by those who already understand. For those who are new, You are speaking too techie.

Did you really invest all your savings back then? If you did you must be rolling the dough now! Coins are at $65.00 today. Even if you did not get in till they were 9.00 that would mean an investment of 1000 would be worth over 7000 now. It would have been hard to hold out this long..coins are very volatile.

@stunt:

No, that’s not what I wrote – I invested all of my savings and all that I was able to borrow.

I tried catching a few swings and ended up losing money every time (I should just have held on to it), but overall, it would be wrong to say anything else than my investment having done very well indeed.

I don’t have quite enough money to retire (at 40), but on the other hand, that scenario is fast approaching.

Also, I would be able to pay back what I borrowed since quite some time back. But I’m not doing that, the interest on bitcoin is quite a bit higher than the interest on the loan… 🙂

Cheers,

Rick

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

as of version 0.3.21, the client shows full precision of transactions, and allows to send full precision amounts. there’s still a .01 fee required for tx < .01 however. but that's going down to .0005 in the next version. as far as microbitcoins – you'll probably find this thread very interesting: http://forum.bitcoin.org/index.php?topic=10049.0

cheers for the nice article, btw. 🙂

Oh, fab! Thanks!

And if you like the article, do retweet it. 🙂

RICK:

“The supply of bitcoin is limited, and on a timescale of years, it is fairly constant.”

How is this controlled??? This is the fundamental question which does`nt seem to have been addressed! At least in fiat money we know which SOB`s are creating more of it.

Bitcoin needs to explain this point, who or what creates the bitcoins? How do we know that some time in the future the entity with the power to create bitcoins will create for itself many bitcoins and cash them in and exchange for paper, gold/silver?

Each BitCoin is numbered, and there’s only a fixed number of possible BitCoins. Once they’re all “discovered”, that’s it.

No single “entity” makes bitcoins. They are created by everyone mining bitcoins with the client and you can’t make bitcoins for yourelf

Robert, Bitcoin is decentralized. There is no entity having power. How Bitcoin works is an agreement of all computers connected to it. I suggest you to go to any website describing how Bitcoin works.

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

"Why I’m putting all my savings into #Bitcoin." | Falkvinge on Infopolicy http://ur1.ca/4ata1 via @glynmoody #dys136

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

Interesting.

Feels kinda iffy to invest so much into a currency which by default is 100% flexible though.

Rick: what is this “tweet” you speak of? 🙂 hehe

Klas: what do you mean by “flexible” ? almost every currency currently in existence is backed by nothing but fiat, and has a floating exchange rate.

RT @falkvinge Why I’m Putting All My Savings Into Bitcoin http://is.gd/G42jAr #bitcoin #swarmeconomy

n: But a fiat is the guarantee of a human government, an organization backed by a nation of people. Bitcoin is backed by a network, and not a very large one at that.

Bah ha ha ha ha, you uber derp.

Cheers for adding value to the currency that everyone is mining for free

There’s an explanation for that. The more nodes get in the net, the slower it is to produce bitcoints for each of them, and one day they won’t be produced anymore. That’s what’s making the cryptocurrency’s value skyrocket.

MT @Falkvinge U thought the © wars were bad? The war over $$ supply is just starting; & I’m going all-in http://is.gd/G42jAr <~k Sheer...1/3

There are also other risks: bitcoin might be like napster and not succeed in the long run, being replaced by a better alternative.

Napster was centralized: Gnutella was the first decentralized, open source alternative, and it is still very strong today: http://en.wikipedia.org/wiki/Gnutella#Software

True. I’m using Napster here more in a shock sense than in a technical sense. We’ve learned a lot about how to make P2P resilient against governments and law since the Napster days.

Gnutella? Really? Gnutella promised search coverage using scoped flooding, and of course it didn’t scale up. If you’re using a k-hop search with m connected peers you’re going to reach a maximum of O(m^k) peers. M is bounded by your network (and usually constrained to a pre-set maximum), and k is a small constant to avoid congestion. When n goes to infinity your coverage goes to zero.

Gnutella was a failure because it tried to do something that is really easy to do centralized (search) in a distributed way. Bittorrent works so well because of centralized trackers with nice web interfaces. Of course these can get taken down, but as long as new sites keep popping up to cash in on the ad revenue I’d say it’s still the superior model.

Gnutella is very similar to Bitcoin though in that it was hyped to death by well meaning programmers and laymen technologists with the distributed systems community standing on the sidelines shaking their heads.

ps: here’s a nice debunking paper on Gnutella: http://www.cs.rice.edu/~alc/old/comp520/papers/ritter01gnutella-cant-scale.pdf

I quote;

“That summer we all saw a rush of press on Gnutella, and the rumour mill started churning. Most stories covering Gnutella were grossly and inappropriately evangelistic, praising the not-yet-analyzed Gnutella as a technology capable of delivering on wildly fantastic promises of fully distributed, undeterrable, unstoppable, larger-than-life file sharing on the grandest scale. Many folks were convinced that Gnutella was the next generation Napster. Gene Kan, the first to spearhead the Gnutella evangelistic movement, claimed in one early interview: “Gnutella is going to kick Napster in the pants.” Later Kan admitted “Gnutella isn’t perfect”, but still went on to say that “there’s no huge glaring thing missing”. Well, something just wasn’t right, and though we couldn’t see it, it did seem pretty glaring.”

“We all understood the excitement. Herein was a technology that could potentially prove the true magnitude of Metcalfe’s Law. That realization evoked nothing short of the phrase “holy shit!”. But what I couldn’t understand was why no one was questioning the legitimacy of these claims. For several months the only analyses anyone heard of practical implementations were generalizations and speculative comments, without much scientific or mathematical basis.”

That’s my feeling, too.

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

What a hero!

I hope you use your Bitcoin-wealth wisely in the future.

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

Ponzi Scheme. Is Bitcoin back by gold or silver? If not then it is all about fiat crap. Hyperinflate bitcoin is the future just like the US dollar.

Is gold and silver backed by anything? How does the supply of gold in reserves compare to the demand for manufacturing of some small tools and cables?

Please do your research, bitcoin can never hyper inflate, there will only ever be 21 million of them.

It can only hyper deflate wich means their value only goes up. So saving in them actually makes sense. the only thing stopping this is if not enough stores accept them as currency.

Maybe you should do your research. The value of a currency is determined by supply and demand, and the supply in turn is determined by the amount of money and the velocity of circulation. Bitcoin can only controll the amount of money but nothing else.

Bitcoins value has in a rather short time dropped from 31$ to 10$. Since there is no prices that are set in bitcoin at the moment, that woud be equivalent to an annual inflation of several billions percents.

http://is.gd/G42jAr gelesen. Jetzt glaube ich, dass Bitcoin total dumm ist und Falkvinge kein VWL kann (und bankrott im Knast enden wird) m(

Two errors in your article:

1. Transfers are not instant, it can take a few hours for a transfer to be confirmed by the network. Which brings me to:

2. Transfer fees. Sure, you CAN send bitcoins without fees, but it is recommended to pay a few extra bitcents per transfer, because it makes the network confirm the transaction faster. In the future with lots of miners, I imagine fees are pretty much a must unless you want to wait days per transfer.

You are factually correct. However:

1) My friend in New Zealand sees the money instantly. It does take some ten minutes for them to be confirmed by the network, so he can spend them. In any case, this is instantaneous compared to the legacy banking system.

2) I did note that transfer fees were optional, and that this transaction was sent without them. It is conceivable that people will choose to days longer time for transactions to confirm, as long as they can see them as pending immediately. I have received fairly large transactions without fees with no problem.

Fees are optional, and transactions without them will probably eventually go through. The point is that with _no_ transaction fees, there will eventually be noone mining either, and then _no_ transactions will be confirmed. Thus transaction fees is an utmost requirement for bitcoins to succeed as minable coins.

>@bitcoinmedia >@Falkvinge copyright wars, bad? The war over #money supply is just starting & I’m going all-in! http://is.gd/G42jAr #bitcoin

[…] Statistics Source: falvinge.net […]

Bitcoin is still in development. It has only about 20000 users across the world. I like it a lot, but it’s probably good to remember that at this momen, Bitcoin is just a relatively small open source project that is in it’s early “beta testing” stage. Just one working exploit could destroy the entire bitcoin economy.

A similar product from some big trusted brand like Amazon, eBay, Paypal, etc. could send Bitcoin back into obscurity real fast too. Nerds would still use it to buy drugs online, but it would never hit “mainstream”. I think that a lot of the value BTC has now is based on this speculation, that it will be big one day, but I dunno.. Fore example Linux has been around for 20 something years and it’s still not user friendly enough to gain mass popularity. It probably never will.

My financial advice would be to not invest any more than you can afford losing.

If I was sure that Bitcoin success would be one day comparable to Linux success, I would invest all my money into Bitcoin.

Linux is huge. It’s on the currently biggest selling as well as most rapidly growing mobile platform (Android). Mobiles since last year outsell “regular” computers.

Mass popularity?

Linux doesn’ẗ have mass popularity? What about webservers, routers, DNS servers etc? Or if you want stuff geared towards “consumers”, what about wireless routers, what about Kindle, what about Android phones?

Linux doesn’t even have a user interface, so saying that Linux is or isn’t user friendly is nonsense. Linux is a component in operating systems that have other components such as Gnome, KDE, bash or various parts of Android providing user-interfaces.

pwned!

falkvinge.net – Why I’m Putting All My Savings Into Bitcoin http://falkvinge.net/2011/05/29/why-im-putting-all-my-savings-into-bitcoin/

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

I have a bridge to sell, would you like to buy it?

Can you buy a car or house with bitcoin? Can you go to college with it? Good luck!

This is the networking effect, the problem that I describe in the article, and why the next level of uptake will be among other kinds of transactions.

Thanks!

Yes, yes and… yes. He didn’t need luck… just incredible foresight.

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

I still can not decide if your a Genious/Visionary or just play Crazy.

But looking at your track record I’m happy I’m already on the bitcoin bandwagon.

RT @falkvinge Why I’m Putting All My Savings Into Bitcoin http://is.gd/G42jAr #bitcoin #swarmeconomy

I love the idea of Bitcoin. And I love the way it is picking up momentum. But as with everything, there are risks. Some that we can predict and some that we cannot. I, therefore, will not invest all my money. Just like I won’t ever put all my money into one savings account or as stocks in one single company. Spreading meens spreading the risks (and the gains, too, unfortunately). I have just wired another €200 into my bitcoin portfolio, and hope to a) gain from its increasing value and b) start buying stuff with it.

Just like with all great ideas, many people spread FUD. The fact that this whole currency is open source makes it ready for a hole flamewar. Like synonymous, telling lies about Linux (android, servers, infrastructure, a fail?) people will lie about Bitcoin. Not because they want to, but because they are badly informed. FUD.

Bitcoin. It has certain risks. But it already has proven to make people a lot of profit. And has already proven to be a valid, usefull payment method.

Lies about Linux?

He said it didn’t have mass popularity – and to anyone but a Linux zealot or who was deliberately missing the point he obviously meant desktop popularity.

Routers and servers are not what anyone but the aforementioned groups think of when they think about “OS popularity”.

Phones are an edge case – but even then he’s right, in that nobody but the zealots thinks “Android is Linux!!!!” in terms of their phone choices and “popularity”.

Linux is not a popular phone OS.

Android is.

Google’s complete stack and marketing and support infrastructure are the value, not the Linux kernel and userland. They could nearly literally just as easily have used BSD.

(This is also why, to explain why he’s even more right on what he actually meant, “the year of Linux on the Desktop” has been “this year or next year” since 1995 – and why the first actually popular desktop Unix came from Apple (based very roughly on FBSD), and why Linux still isn’t more than a footnote in that market.

Nobody in the target market cares about “Linux” or “BSD”. They care about good user experience, and that’s so much more work than anything else that you can graft it onto any Unix you want, if you have that level of manpower and the ability to do good interface.

Gentoo will never make a decent desktop because they don’t have that. Apple could have made one on any Unix because they do.)

In short, “statement you didn’t read closely enough to understand” and “lie” are not isomorphic categories.

(And on your novel claims, “past performance is no guarantee of future results” is an important thing to recall.

In 2001, it was “proven” that real-estate speculation in Miami had made people a lot of profit, after all. And then it all fell apart.)

I see that you are trying to say that because Linux works invisibly behind a user interface and can be replaced by another kernel it should not be counted. It’s like saying that every metal producer is a failure because people call the products including those metals by the name of the company assembling the product and not the company producing the metal.

Why I’m Putting All My Savings Into Bitcoin http://zite.to/mLFhDc via @Ziteapp

How much savings did you have? If it was $20, who cares.

Enough to move the bitcoin market when I changed it into bitcoin. Other than that, exact numbers are not relevant.

Wasn’t you in like EUR 30,000 in debt 2 years ago? How much savings can you possibly have now?

Looks like he’s doing ok now right? 🙂

Why I’m Putting All My Savings Into Bitcoin http://is.gd/G42jAr #bitcoin #swarmeconomy RT @falkvinge

LOL…BITCOIN.

They show a picture of what looks like shiny gold coins, but they are not, because BITCOIN is not backed by ANYTHING but 1’s and 0’s…it’s Digital $ (.)

This will be your cashless society…currency backed by NOTHING…just like everything is today.

BITCOIN is not MONEY. There is a dfference between CURRENCY and MONEY. MONEY must be everything a CURRENCY is, but also be A STORE OF VALUE.

BITCOIN…LOL…SHTCOIN is a better name.

Money does not need to be backed by anything, it just needs to be rare, fungible, divisible, accepted as money etc. Bitcoin is money.

Yep, bitcoin is backed by nothing but the expectation that other people will continue to consider it having value. Just like USD, Euro, and every other currency that is relevant tody.

You said it yourself didn’t you? “real” money today is, in fact, backed by nothing. Unless you’re into the “liberty dollar”, you already use something quite similar to bitcoin no matter whether you use ordinary greenbacks or an ATM card to purchase things with.

And what backs gold and silver? Oh.. it’s backed by NOTHING either!

And talking about STORE OF VALUE, just compare the two graphs below and make your pick:

Total amount of gold ever mined: http://www.moneyweek.com/~/media/MoneyWeek/2011/110404/11-04-07-MM02.ashx?w=450&h=326&as=1

Total bitcoins over time: http://en.wikipedia.org/wiki/File:Total_bitcoins_over_time.png

This, sir, is an effing *brilliant* comparison! The contrast could not be any more stark.

You can see that the protocol is designed to produce at a steady rate over time – starting quickly, and slowing down over time. Comparing these graphs really shows the strength of the design of bitcoin.

FYI: http://news.ycombinator.com/item?id=2596475

I’d never recommend that people put all their money into currency speculation because of the extreme risk involved. It’s much more responsible to tell people to become economically productive and sell goods and services in the currency so that you get a *sustainable* increase in the value of BItcoins.

so the real question is, how fluid is the conversion back to conventional currency. That is, IF I place USD$1 into BTC and it rises in value to USD$100, am I able to trade that BTC currency back for any other conventional currency just as I am able to do between USD & EUR e.g..

That will technicality will have considerable sway on adoption of BTC as a currency for obvious reasons, not the least of which will be speculation and “short sales”. The ability for an individual to drive the value up, and then dump BTC for conventional currency could be as hazardous in the ether as in “the market”.

Currently, the only real way to convert the bitcoins back into traditional currency is by trading it out with people who want bitcoins. Mt Gox trades about a million bitcoins per month (you can see some statistics here: http://bitcoincharts.com/markets/), so it is fairly easy to get your money back out.

How much of the bitcoin transactions are actual payments for goods or services, and how much of it is currency speculation? If the latter dominate, as everything I’ve read about it indicates, doesn’t that make the system incredibly vulnerable and risky as an investment?

Also, considering the small number of actual exchange sites, what would happen to the value of bitcoins if it suddenly became much harder to buy dollars for them? For example if the government of the country where MtGox is running decided that it was illegal, and shut it down?

Excellent article, and as @ploum said : if i were sure bitcoin would get the same success as linux. I would have spent all my savings in.

There’s no relationship between the amount of money that people have put into Bitcoin and the price at a given time. If almost everybody doesn’t want to buy bitcoin for the next hour, the price is whatever someone will accept. This is the same as a stock price – it’s only linked to supply and demand at a given point in time, not how much money has actually been put into a stock.

This is true. My description is somewhat simplified.

Still, if people want to trade $60B of value using the bitcoin network, the sum of bitcoin will be worth at least that much.

But you’re technically right. Everything is worth exactly as much as somebody is prepared to pay for it at that point in time.

Someone took his real cash and gave him a .jpg of gold coins with a leprechaun next to them. LOL. Not like our money today isn’t valued on anything, but I can still buy day to day things with it.

Why I’m Putting All My Savings Into Bitcoin http://bit.ly/lrnXiO – thoughts on bitcoin anyone?

You can’t be serious, it’s a joke right?? You expect me to believe you put all your savings in a “file”??? The numbers you have just stated in your article add up to one result only: BUBBLE! A stampede in an out. And yes, more Bitcoin will be placed on the market to meet demand, it’s called greed and it will happen, watch it….May I suggest you convert you life savings back to fiat tyen convert again to gold and silver whilst you can, if you really were foolish enough to convert everything to Bitcoin, that is..

If you’d look into how Bitcoin actually works you’d see that it’s mathematically impossible to add Bitcoins due to greed.

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

@ Jack: oh yeah? Isn’t it plausible to think Bitcoin will need to devalue if it’s going to be successful? So that ppl can afford to convert that is….secondly, transfer fees are actually flying around, so more Bitcoins, more fees, correct? Now then, write in this post an elaborate description of you “mathematical” analysis as of why no more Bitcoins may be added…

New bitcoins are generated by computing lots and lots and lots of SHA hashes. Short of a revolution in CPU technology, it is not possible to generate them much faster without spending a lot of money on it. There is no central bank that issues the coins and can decide how many to release during a certain period.

What about an advert that calculates a small part of the problem in a small flash/javascript app?

The rate of creation is an agreement between nodes. If you are not running the majority of the well-connected nodes in the network (which is not very feasible, since nodes are not extremely naive and they are spread around the world), you can’t create money out of thin air.

The network creates 6 blocks per hour on average. If it creates blocks slower or faster than that, network adjusts the difficulty to generate blocks to compensate, so that coin generation is predictable. Currently, each block carries a 50 BTC transaction to the generator of the block. So only 300 coins in total are created throughout the world each hour. This amount is halved every four years.

(See: https://en.bitcoin.it/wiki/Blocks)

bitcoins can be divisible. You can go down to .00000001 bitcoins currecntly. with 21 million total bitcoins, and if the value of .00000001 bitcoins is one dollar, that means the bitcoin economy in whole can handle 2,100 trillion dollars. The World Bank estimates there is $40.887 trillion in the world.

Transfer fees are collected by the mining computers, and go back into the economy.

Bitcoins cannot be added to the system because it is designed to automatically reject invalid coins, and if someone were to alter these rules to allow their client to accept them, their client and the coins they make cannot be used on the original bitcoin network and will be rejected.

Another ‘threat’ to the appreciate of btc is a competing crypto-currency. The number of btc’s may be mostly fixed, but the number of such currencies is wide open. And I tend to think it would be a good thing to have more such operations/networks on the go. Mind you this would not be a threat to the core value of btc, just it’s speculative value.

I would like to see a good competitor to bitcoin. However bitcoin has the huge advantage of being first to the game.

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

Thus there’s no limit to the new issues, according to your description….what happens when people sell Bitcoin for fiat, do the hashes “retire” the surplus Bitcoins?

You don’t seem to understand how currencies work at all. What happens when someone sells USD for EUR? Do the dollars “retire” to the federal reserve? Of course not, they are now owned by the person who sold the euros. The same thing happens with bitcoins.

Is this a valid long term money experiment? RT @falkvinge http://is.gd/G42jAr #bitcoin #swarmeconomy

1. Could I print bitcoins out, with some kind of barcode for the signature? And the the hotdog salesman just hold it up to the webcam to get the validity confirmed?

2. Is there a link to a more technical description? The most interesting thing is how the amount of money is limited. Should calculation capacity for hashes transform linearily into Bitcoins, the currency WILL loose most of its value as computers go faster at and exponetial rate. But I think there was a scheme to prevent that, wasn’t it?

1. If you are doing “out-of-band” transactions, e.g. giving someone a private key to a bitcoin address with a fixed amount of money on it, there is no way for the receiver to be sure that you aren’t double spending, e.g. giving the same private key to several people. Working around this probably requires a physical system that is as hard to forge as real cash and issued by someone who everyone trusts, and then you might as well use regular cash instead. If you want to read about a cash system built on top of bitcoin, search for “bitbill”.

2. The currency generation is limited in several ways – first, the computational problems to solve become harder and harder with time (the threshold that a hash value must be below in order to be considered a “solution” is lowered), the number of bitcoins awarded per solution gets lower and lower, and there is a fixed number if bitcoins that can be generated. Once that number is reached the award for solutions will come entirely from transaction fees.

All these limitations come from pre-defined rules and will only work as long as a majority of the nodes on the network agree on them, which I think makes the system a bit fragile.

Dear oh dear, it’s not about Forex….it’s about the actual money supply…you do realise that any central bank in the world can dry up the money supply as a control tool….they “retire” currency from the market….Simple question: can the underlying code execute such task???

Anyone can buy bitcoins and then erase their wallet files, in which case those coins will be gone forever.

Why I’m Putting All My Savings Into Bitcoin http://is.gd/G42jAr #bitcoin #swarmeconomy RT @falkvinge

If you have Firefox 4, you can mine Bitcoins using your video card here: http://kradminer.com Mining using your video card is 100’s of times faster than cpu mining.

Ok thank ANNM, I now have the necessary elements to make an informed decision

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. http://is.gd/G42jAr #bitcoin

This is beyond stupid! Hope no one follows Ricks example.

Would be interesting though to know how much of Swedish taxpayers money he is going to invest, as Rick’s “fortune” is built with taxpayers money.

You are really desperately hoping he’s wrong as if he’s right he will in the next few years have made millions?

And no, Grozkov, Rick performs a duty in return for his salary. Whatever he does with said salary is his own choice. Unless your intent was to imply that every official employed in sweden is guilty of embezzlement and fraud because they invest their salaries in the stock market, i think you should shut up now.

I own stocks in the market, paid for by the salary my employer gives me every month. According to your warped logic that makes me an embezzler from my employer?

Do you, actually, not have anything factual or relevant to add to any debate?

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

Putting everything into bitcoin. genius or total idjit? http://j.mp/l1bvNO

Dear Rick,

I don’t want you to lose your money and I think that there are huge risks in this speculation gamble. Here are the red flags:

The extreme appreciation of Bitcoins is probably driven by media attention and by private US investors who don’t fully understand the nature of this instrument. I think that this is driven by the same factors that have pushed the price of gold and silver through the roof – the fear of a total collapse of the US dollar and hyperinflation. Look at inflation.us for an overview of this worldview. If US hyperinflation doesn’t occur these instruments will most likely fall in value (including Bitcoins).

A currency with such a volatile price is hard to use as a value keeper and a medium of exchange. If it goes up like this it might as well go down, adding uncertainty to normal trade transactions. Speculators might love how Bitcoins have appreciated but the price volatility adds an increasing risk of a price collapse.

Even though Bitcoin is the market leader in this emerging segment for P2P money today, the principle can easily be replicated with other coin schemes. The psychological effect of using micro-Bitcoins should not be underestimated. If people have to sell their car for to get 0.1 micro-Bitcoin they will think twice about the risks of a value collapse.

Other “currencies” that start without this extreme value appreciation for the early adopters will feel fairer and less like being the last entrant in a Pyramid game.

Finally, future quantum computers might make it very easy to “mine” the remaining Bitcoins.

The day quantum computers are used for tasks as bitcoins mining, I think we would have other problems to care about 😉

…like the breakdown of ALL current cryptosystems, including the one used in bitcoin. 🙂

Not necessarily. Tunneling public keys (key exchanges) over OTP would probably make it at least quite difficult even for quantum computers.

Correct me if I’m wrong, but isn’t the biggest vulnerability of bitcoin, the possibility that a massive amount of computing power / nodes could be brought online to either prevent confirmation of new transactions, or confirm false transactions? An entity with the right amount if resources (say, the NSA) would be able to do this, no? And (putting on my tinfoil hat) surely some nefarious government entity will have access to quantum computers long before anybody else…

Also, re: the meteoric rise of BTC value, do we have any idea of the daily transaction volume? ie, is anybody really USING them yet, or is the price simply increasing due to hoarding / speculation / nowhere to spend it?

A botnet would also be able to do what you say. So it’s a very real concern…

Actually the problem is not so much botnets trying to take over, as much as miners getting ddossed by other miners to increase their chances of getting coins. It’s already happening.

You can see the daily transaction volume here: http://bitcoinwatch.com/ , but it’s hard to tell what the transactions are for, and most of them wouldn’t probably fit your description of “using”. But I can confirm from personal experience that at least part of it is for goods and services.

Untrackable, huh?

Every Bitcoin node knows about your transactions because it is in block chain now.

See here: http://blockexplorer.com/address/1NCNQf4ww3CZisNyD4J9XZQBQKt28Bj45H

Now we know you Bitcoin addresses, that is, addresses you’ve received Bitcoins to. They can be used to find parties who have sent you Bitcoins, your other addresses (as client often uses multiple addresses to send money) etc. It is much more trackable than you think. To be really anonymous you need to use certain tricks, e.g. anonymizing services, but then you depend on those services…

Oh, and we know whom you send that money too: http://www.google.com/search?q=1NCNQf4ww3CZisNyD4J9XZQBQKt28Bj45H

That’s clever, and Rick could ask the recipient to generate a new key not visible to Google if he didn’t want you to find out whom he send the money to.

Did you write this article to pump up your own bitcoin value by enticing new user? This is classic ponzi. When faith in this ‘currency’ is lost then so to will be your money. Traditional fiat currency is at least based on the economic health of a nation. Bitcoin is based on nothing. A fool and his money…

Bitcoin is based on a decentralized structure which makes it more robust to centralized middle-men fiddling and gambling about (banks or other financial institutions gambling away the wealth of investors). We had a situation like that not so many years ago in the United States. Quite some banks were bailed out by their governments (in the end by the tax-payers).

Is this a valid long term money experiment? RT @falkvinge http://is.gd/G42jAr #bitcoin #swarmeconomy

The state is not likely to protect your Bitcoins from theft. The courts will not enforce any transactions involving Bitcoins. Real money is backed by the state monopoly of violence.

Well if that was true then banks would be allowed to fail and not be bailed out after financial fails like that 2-3 years ago?

It’s much more like the state monopoly of violence will not be able to seize your money to bail out the big banks. Which actually was quite a bit of what happened 2-3 years ago.

Fascinating. Bitcoin seems to function properly as a trusted third party to settle transactions , and as a store of value. Gresham’s law should not be a problem as the “bad money” competing to drive out bitcoin can simply be improved by converting it to bitcoin. The modern monetary theory crowd will argue that bitcoin won’t be accepted in payment of tax. Sounds like a feature not a bug to me. I expect the next big opportunity will be escrow, and bitcoin lending. Also simple password authorization of same without wallet hash is desirable. Many issues to consider. Many advantages too. It will start with curmudgeons like me. So be it.

Hi, I’m a PhD student working at a parallel distributed systems department. I strongly advise anyone against investing heavily in Bitcoin. The problem is that there is no way in hell the system as it is currently designed is going to scale up in the face of transactions/second.

The reason why peer-to-peer systems tend to work so well is because they distribute the load over multiple nodes. The assumption is usually that these nodes are ‘friendly’, and p2p networks are notorious for being vulnerable to attacker nodes who can game the system for their own purposes. To avoid this, Bitcoin does not distribute the work, rather it replicates it. More transactions means more work, and more nodes also means more work as every transaction must be broadcast to every node. The reason why your transaction takes minutes is because the transaction rate is currently limited artificially to only 7/second. The only way for Bitcoin to scale up to support a large economy is to move the nodes to data centers like the ones Google, Microsoft, Amazon, and Yahoo have. There is already talk about a two-tier system to incorporate such ‘power nodes’.

https://en.bitcoin.it/wiki/Scalability

It seems, from the link you provide, that the problem is already being addressed in a serious manner?

If you read their page you can see that they have no clue how to scale it up. There is no clear path towards high volume transactions, only a vague idea of using supernodes. As soon as you have such a two-tier network you basically have an elite of high-powered data centers owned by big corporations running your system rather than a flat network of anonymous commoners like you and me. I wonder how economical it is to run a supernode which shifts around a gigabyte of data/second, and whether anyone will be able to get return on investment in the near future. Note that these are numbers for 2000 transactions/second, which is what VISA is doing right now using a centralized system. Their own discussion on scalability describes the supernodes required to handle this volume as ‘futuristic’. In other words, they admit that Bitcoin needs futuristic bandwidth just to be on par with VISA.

What bitcoin is proposing is basically taking the VISA servers and replicating them all over the world, and then keeping all the replicas in sync. If there’s any disagreement over a transaction, there’s majority rule. To make sure people don’t just throw botnet at the system to get a million votes, they make everybody do a lot of useless calculations so that you need to have more processing hardware than everybody else in the network put together to be able to get majority So now you have a decentralized system that has become so inefficient in both processing and communications overhead (all nodes need to be synced) that at some point ordinary machines and consumer-grade bandwidth cannot keep up.

What you end up with is a system run by big corporations, with all the legal and financial consequences that brings along with it.

I am mining on cpu, which is very slow, yet value of my 10 btc has gone from nothing to $80:) and rising

Now, if someone would set up a fractional reserve banking system that supports bitcoins…

I’m more philosophically inclined to trust systems like ripple. Where the fractional reserve problem is distributed per individual user, and there is full legal support. At least in Swedish law. One should agree on a base for the money creation thought.

[…] Why I’m Putting All My Savings Into Bitcoin […]

This article on Bitcoin, which works on similar principles but on high speed, reminds me of that: http://bit.ly/l1bvNO

You might want to consider that bitcoin is flawed; here’s an article (which, frankly, I don’t understand) from a cryptographer expressing doubt:

http://www.links.org/?p=1175

“I challenge you to find one other commodity with this pace of appreciation.”

Tulip bulbs. Netherlands. 1637.

Why I’m Putting All My Savings Into Bitcoin http://zite.to/mLFhDc via @Ziteapp

Makes me think of “For the Win” by Cory Doctorow. For some reason.

If past performance does not predict future returns, YOU CAN’T USE IT AS EVIDENCE. Yet it’s your *number one* piece of evidence that you’ve used to put your entire savings and then some into Bitcoin.

You’re either lying or you’re one of the biggest idiots to ever walk the planet. I hope you lose your shirt, because if you get lucky that’s all it’ll be, luck, yet others will walk away thinking that it’s a good idea to jump off a bridge just because everyone else is.

My primary worry would be liquidity.

-Because the demand to buy bitcoin is low, the likelihood being able to sell the bitcoin whenever he wants (ideally at height of bitcoins worth) is also low. This is the same reason that penny stocks are difficult to make a profit it. While the value may go up significantly, you can’t realize this profit until you find someone to sell it to (and in order for them to buy it, they have to think it’s going to go up even further). USUALLY PEOPLE TRY TO DRAW ATTENTION TO THE PENNY STOCKS THAT THEY OWN TO INCREASE DEMAND (AND THEREBY PRICE), AND THEN SELL EVERYTHING BEFORE THE BOTTOW FALLS OUT. Hopefully that’s not what you’re trying to do here…

-Currently there aren’t too many companies that accept bitcoin for products or services.

-Any currency is only as valuable as the people using it believe it is (ie. the dollar is only a piece of paper, but because the seller believes that its worth is equivalent to a candybar, he will trade it).

-Once people realize that they cannot use bitcoin for goods or services, the likelihood is that there will be a mass exodus, and the price will fall rapidly as people want to sell their un-useable bitcoin for a currency that still has value. With so few buyers, the discount will likely have to be pretty hefty in order to attract other buyers into a falling investment.

Just like it is a bad idea to put all of your eggs in a single basket, it is a bad idea to invest all of your wealth in a single asset. There is a reason why professional investors never ever do that.

And it looks to me like the price of BTC shows all the classic signs of a bubble: There are no changes in the fundamentals, like increased BTC liquidity or less BTC being offered in the market.. Instead we have a lot of new and unexperienced investors coming into the market, expecting that the price will continue to rise.

But if/when the the offers to buy fall back to a more normal level the price of BTC will bounce back.. When this happens many of the people who geared their investments (like Falkvinge effectively did when investing for borrowed means) will be forced to go out of the investment to cover their losses, and price falls will accelerate. I would not be surprised if we saw the price of BTC bounce back very quickly to below USD 2 at some time within the next half year.

I agree that hedging against the coming financial crisis is a good idea. But Bitcoins will not buy you food if you have no electricity. Gold will. It is worth listening to people who experienced the financial crisis in Argentina, though I expect the coming crisis to be much worse. Here is an example: http://www.survival-spot.com/survival-blog/argentina-collapse/

The fundamental we can use to evaluate bitcoin is the difficulty factor – the size/power of the network. It is growing exponentially, along with the price.

Liquidity is also increasing, fast. Volume traded on mtgox is lately surpassing $400,000 USD daily. Volume was $10,000 USD not long ago.

Big changes in the fundamentals (to match the big change in price).

Yes I agree that you shouldn’t have all your eggs in one basket. A more moderate way of doing it would have your own PC mining bitcoins whenever you don’t use it. That way it won’t cost very much for you (maybe a small hardware upgrade once in a while, not too expensive), and you’ll still profit after a while if bitcoins really turn out “mainstream”.

RT @Falkvinge: You thought the copyright wars were bad? The war over the money supply is just starting. And I’m going all-in. http://is.gd/G42jAr #bitcoin

That was an aggresive move. If you lose your savings fine. You have still your income. If you lose borrowed money then you have to pay back many years.

So if you put in thousands and *if* only sky is the limit then you have millions to play with some years later.

Something like that, yes. The rule that you should never risk more money than you can afford to lose stands true. I have not risked more than I can recover from in a worst case scenario — as you say, I still have my income and I will be able to pay my bills.

But then again, bitcoin has huge political effects that I want to encourage, too. If I can make a buck off of it in some five-year perspective, all the better. I believe in this.

Why I’m Putting All My Savings Into Bitcoin http://zite.to/mLFhDc via @Ziteapp

I would say the biggest risk is that everything you own is stored in a file. If say a virus/malware is able to get a hold of that data and phone home, what’s to stop it from transferring funds around? No law is there to protect you from theft and like others have said, it is purely digital.

Just like criminals that mine gold on World of Warcraft (yes this true, google it) there will be those that do it for bitcoin too. Love the idea but I think the tech community has a ways to go to perfect it. For now, this is an experiment where the original owners and creators are making a profit off of speculation like any other stock in the stock market.

This risk can be mediated by storing your “savings” wallet in multiple places in an encrypted form. Alternately savings can be stored at an online wallet service. This would be safe from any virus from getting it on your computer, but adds the vulnerability of a dishonest online wallet service operator.

Well, you could divide your “saving” coins in multiple wallets, encrypt them and create many redundant remote copies. If I stole your computer, I would only have access to the coins you keep in your “current” wallet. Besides, encrypted wallets will be introduced soon, on the default client.

Well, in that respect WoW gold miners and Bitcoin operations would be no different than Burmese sweatshops. Although there may be problems with scaling and several other assorted issues, ANY currency or value today is subjected to “mining”.

Bitcoin is a defationary currency by construction.. I I got ahold of some, I would keep them and spend my USD/SEK/EUR instead. There is a risk of Bitcoin being highly illiquid.

However, I think that the biggest threat is the possible success of Bitcoin. Should it become popular and useful, it will be outlawed in all nations. Punishments for holding Bitcoin will be at the level of printing your own money. Governments will use their monopoly on violence to protect their monopoly on minting currency. Otherwise the core power of governments will go away.

While you can possibly persuade governments not to do house searches for copied music, this will not be the case for alternative currencies. No effort will be spared in asserting government control over national finances. As long as the alternative currency stays fringe (like Canadian Tyre money for instance), it can be tolerated, but as soon as it empowers people to circumvent taxation, money laundering prevention or gives people the ability to send money internationally without government control, you will have the authorities coming down on you like a ton of bricks.

Absolutely. In this scenario, it’s going to be as close as you can get to an all-out civil war between the taxers and the taxees, and be very interesting.

I wrote more about this in my first post in the subject, “the Napster of Banking”.